Stapling — what does it mean for you and your employees?

21 Oct 2021 5 min readAs part of the Your Future, Your Super (YFYS) reforms, stapling will start on 1 November 2021. From this date, employers will need to use a new process to choose the correct super fund for new employees. Read on to learn what stapling is and what you need to do.

What is ‘stapling’?

Stapling is the process of linking a super account to a member (or employee). A stapled account will follow that member from job to job, preventing employees from picking up a new super fund each time they change jobs.

An employee can still choose their preferred super account by completing a Choice of fund form.

However, if they don’t do this, you’ll need to log in to Australian Taxation Office (ATO) online services and enter their details (including their tax file number) to obtain their stapled fund.

If an employee completes the Choice of fund form, their choice always takes priority over a stapled super account. If they do this at the start of their employment, you won’t need to get their stapled fund from the ATO. If an employee provides a Choice of fund form at a later date, that choice must then be used, regardless of the stapled account.

If your employee is with NGS, they can opt to use our prefilled Superannuation choice form.

Download NGS choice form Download ATO choice form

How do I know which super account to pay to?

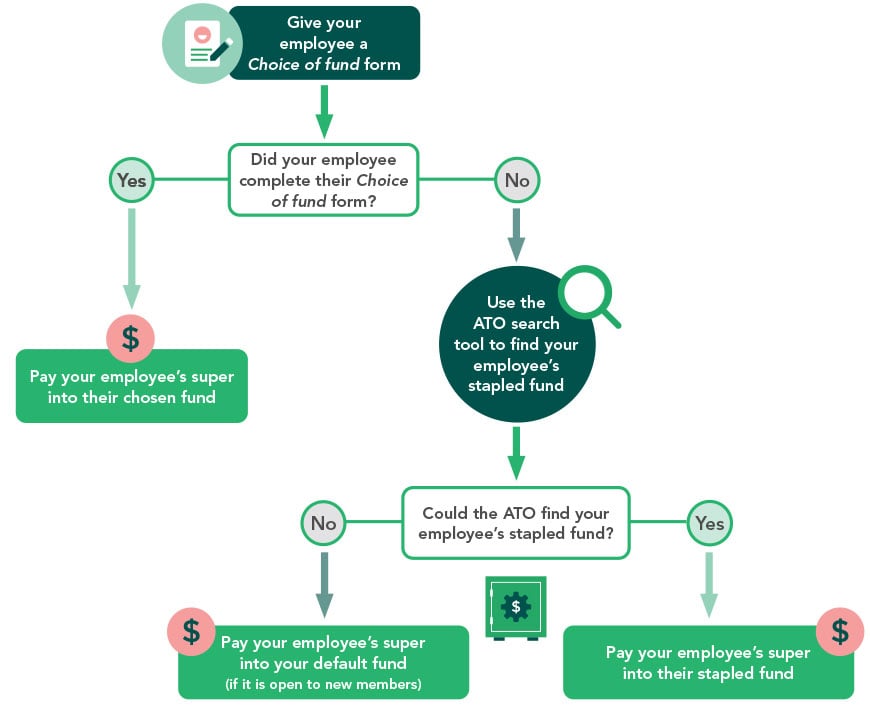

The process for selecting the right super fund is as follows:

- First, provide a Choice of fund form to your new employee (required).

- If they complete their form, pay their contributions to the super account they nominated.

- If they do not complete their form, you’ll need to obtain their stapled fund using the ATO’s search tool (available through ATO online services from 1 November 2021). If your employee doesn’t have a super fund, the ATO will let you know, and you’ll need to open an account for them with your default fund.

Note: Only the ATO can determine a stapled fund, and you must use the ATO search tool even if your employee thinks they know who their stapled fund is. Your employee should complete a Choice of fund form if they want to choose an account other than their existing stapled fund or the employer default fund.

Stapling FAQs

When does stapling start?

Stapling starts on 1 November 2021 for new employees who commence on or after 1 November 2021. You will need to follow the stapling requirements from that date.

Do I have to provide a Choice of fund form?

Yes — you need to offer eligible employees a choice of super fund and pay their super into the fund they choose. Most employees are eligible for this choice.1 They can select an account they already have or opt for your default fund. Remember, you cannot provide advice or recommendations about super to your employees.2

1 For full details on eligibility and exemptions, visit the ATO website.

2 You can only provide financial advice if you are licensed by the Australian Securities & Investments Commission (ASIC) to do so.

How do I know which super account is my employee’s stapled account?

Only the ATO can determine an employee’s stapled account — you’ll need to use their search tool (available from 1 November 2021) to obtain it.

What if my employee has multiple super accounts?

The ATO will select one stapled fund based on a prioritisation system.

How does the ATO choose the stapled account?

When someone has multiple super funds, the ATO will consider things like the account balance, when the account opened and when the last contribution was made. Then, they’ll let you know the stapled fund to use.

What if my employee doesn’t have a super account?

You should still use the ATO search tool, just in case. If they can’t provide a stapled fund, you may open an account for your new employee with your default fund.

Do I still need a default super fund?

Yes — if an employee doesn’t choose their fund and doesn’t have any existing super funds, you’ll need to open an account with your default fund.

I’m paying to my employee’s stapled account, but now they’ve provided a Choice of fund form. What do I do?

You should pay all future contributions to the account selected by your employee in their Choice of fund form. Choice of fund overrides their stapled account.

I have lots of new employees starting — is there a quicker way to find stapled accounts?

If you need to search for more than 100 stapled funds at a time, you can make a bulk request with the ATO. Bulk requests will take up to 5 business days to process. You can submit a bulk request using an xls or xlsx file, available on the ATO website from 1 November 2021. For more information, visit the ATO website.

The stapled account rejected my contribution payment — what should I do?

You’ll need to submit another request with the ATO for the employee’s stapled super fund. If the ATO provides the same stapled account again, you’ll need to call them on 13 10 20 to obtain an alternative stapled account.

What happens if I’m not ready in time for stapling?

You could be liable for penalties if you do not comply with the stapling rules from 1 November 2021. For more detail, visit the ATO website.