Easy Default

Deciding the right time to retire can be difficult. But deciding how to invest your retirement savings doesn’t need to be.

When you select Easy Default, with one tick, you’re choosing to receive a regular stable income and opting for an investment strategy that will help you manage retirement risks.

And Easy Default gives you the flexibility to change your payment options or how your retirement savings are invested at any time.

Why choose Easy Default?

- A simple way to set up your account using default investments

- Regular fortnightly payments

- Sound long-term returns

- The flexibility to change your payment and investment options

- Helps manage some of the risks of retirement.

How does Easy Default work?

You can select Easy Default when you’re setting up an NGS Income account or NGS Transition to retirement account. Here's how it works:

If you select the Easy Default option when opening an NGS Income account, the default investment strategy will apply, and your savings will be invested into two ‘buckets’ — your ‘cash bucket’ and your ‘growth bucket’.

Cash and Term Deposits

(Cash bucket)

12% will be invested into your cash bucket. Your fortnightly income will be drawn from this bucket.

Retire Plus

(Growth bucket)

The remaining 88% will be invested in Retire Plus which is designed to deliver sound long-term returns.

The cash bucket is designed to meet your income needs and help manage risk in retirement by minimising the need to draw funds from your growth bucket during any market downturns in the first two years of retirement.

The growth bucket is designed to deliver returns with less volatility than listed shares or a traditional balanced fund. Retire Plus invests in diversified assets designed to deliver a steady income and with improved stability of returns over the long term.

For members below age 75, your regular payments will be made from your cash bucket at an amount of 6% p.a. of your initial account balance.1 The dollar amount of payments in the first year will remain the same in future financial years, and will be adjusted where required to meet minimum required payments.2 If you’re aged 75 or above and opt into Easy Default, your payments will be paid at the minimum required level.

When your cash bucket is nearly empty, we’ll let you know so you can choose to top it up if you wish. You also have the flexibility to choose another investment strategy if your needs change.

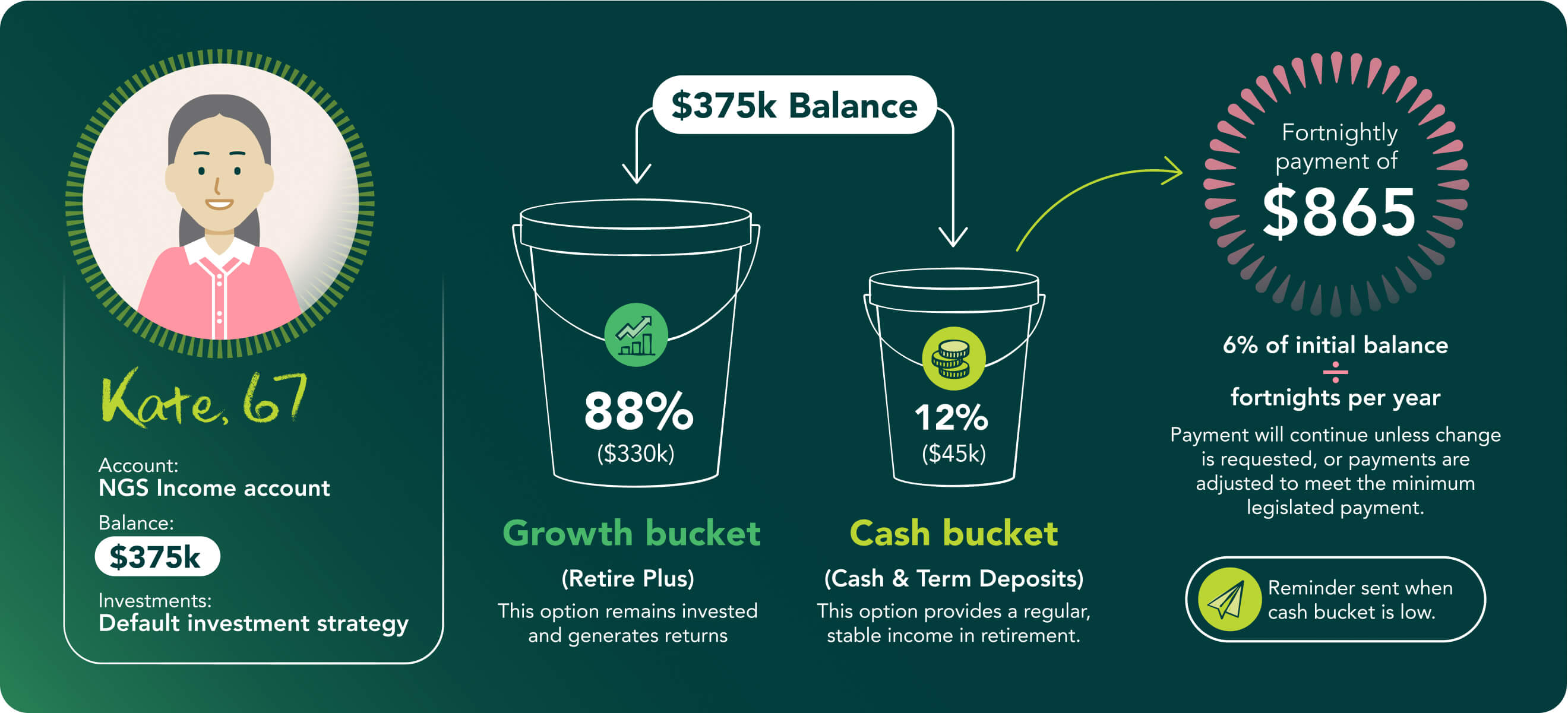

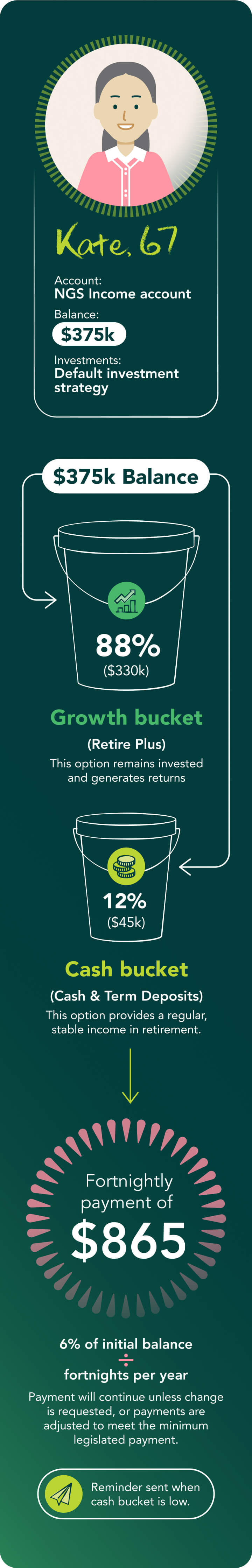

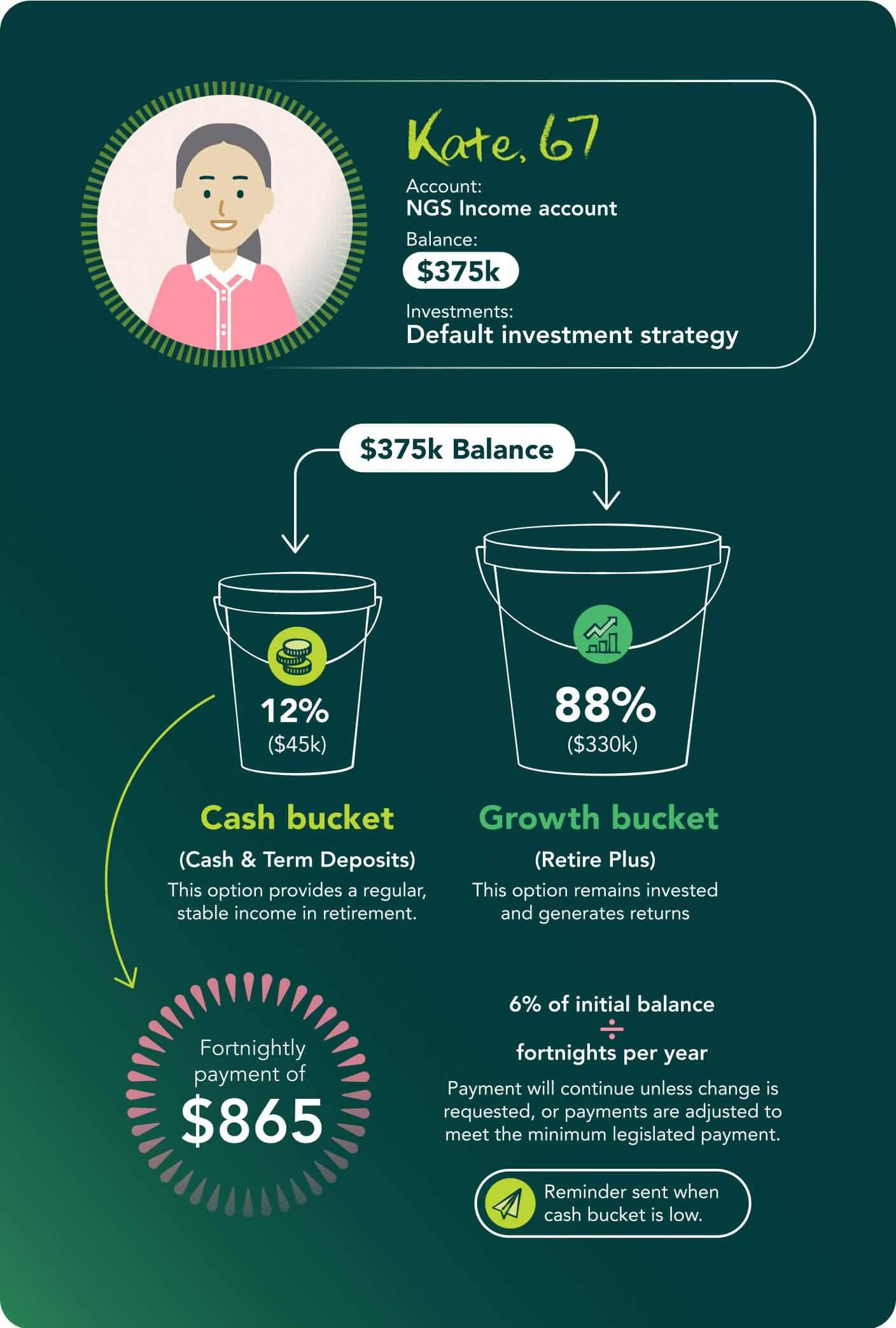

Here's an example of how the bucket strategy works

Kate is 67 and sets up an NGS Income account with a balance of $375,000.

She chooses Easy Default, as she’s looking for an investment strategy that takes the guesswork out of choosing investments, and provides a regular, stable income in retirement.

12% of her balance ($45,000) is invested in Cash and Term Deposits. The remaining 88% of her balance ($330,000) is invested in Retire Plus. If there are any market falls in the first two years of her retirement, Kate won’t be drawing money from Retire Plus (her ‘growth’ bucket), allowing this option to remain invested and generate returns.

Kate receives a regular income payment each fortnight of around $865 (6% of her initial account balance, divided by the number of fortnights in the year). 26 fortnightly payments are used in this example, this may vary from year to year.

She’ll continue to receive the same payment amount unless she requests a change, or her payments are adjusted to meet the minimum legislated payment amount.

1 For members below age 75, the dollar amount of payments in the first year will continue to apply in future financial years until you tell us otherwise (subject to meeting minimum legislated payment limits). For members aged 75 or above the minimum legislated percentage payment amount will apply.

2 Where you join during the financial year, your annual payment amount will generally be pro-rated based on the number of payments remaining in the first financial year.

Helping you manage risk in retirement

Now that most of us are living longer, our retirement savings need to last longer too. The NGS Income account default investment strategy has been designed to help you manage some of the risks in retirement.

The default investment strategy can help manage the impact of:

- negative fluctuations in the value of your retirement savings (market risk), and,

- negative investment returns in the early years of your retirement which can impact how long your retirement savings may last (sequencing risk).

The default investment strategy helps to manage these risks by investing in:

- Cash and Term Deposits, to draw your income payments from in the first two years, minimising the need to drawdown from your growth bucket during any market downturns, allowing time for growth investments to recover.

- Retire Plus. This option invests in diversified assets with a higher allocation to infrastructure and property, and aims to provide steady income and improved stability of returns.

Setting up Easy Default

To set up Easy Default on your NGS Income or NGS Transition to retirement account, simply tick Easy Default on the application form, and we’ll do the rest. You can also select Easy Default if you decide to reset your existing NGS Income or TTR account.

As a new member of NGS Super, or an existing member ready to open an NGS Income or NGS Transition to retirement account, simply download and complete the application form in the NGS Retirement Product Disclosure Statement (PDS). Make sure you also read the Target Market Determinations (TMD) before you get started.

General Advice Warning

The information provided is general information only and does not take into account your personal objectives, financial situation or needs. Before acting on this information or making an investment decision, you should consider your personal circumstances and read our Product Disclosure Statement and Target Market Determinations for more information. You should also consider obtaining financial, taxation and/or legal advice which is tailored to your personal circumstances before making a decision.

Call us on 1300 133 177 if you would like to speak with us further, or you can discuss matters with one of our NGS Super Specialists, or an NGS Financial Planner.