Your super obligations

How do employer super contributions work?

As an employer, you are generally required to pay a minimum of 12% of ordinary time earnings (OTE) for an employee over age 18, regardless of how much they’re paid. This is called the super guarantee (SG). For employees aged under 18, you must pay the SG if they work at least 30 hours in a week.

OTE usually include:

- pay from ordinary hours of work

- specific allowances

- paid leave

- shift loadings.

You must also pay super for independent contractors if you pay them mainly for their labour, even if they quote an ABN.

You may also have to make super guarantee contributions for an employee under an award or industrial agreement where relevant.

If you provide your employees with the option to salary sacrifice some of their income as a super contribution, the sacrificed amount does not reduce your SG contribution rate. This means you must pay the salary sacrificed amount in addition to your SG contribution.

Stapling — what does it mean for you and your employees?

As part of the Your Future, Your Super (YFYS) reforms, stapling commenced on 1 November 2021. Employers need to use a new process to choose the correct super fund for new employees.

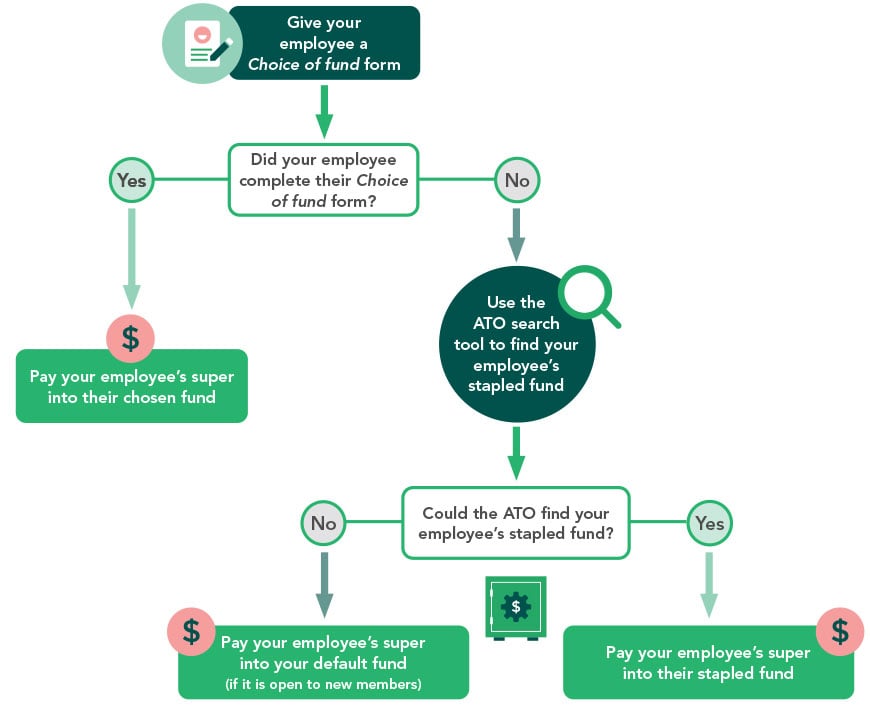

Stapling is the process of linking a super account to a member (or employee). A stapled account will follow that member from job to job, preventing employees from picking up a new super fund each time they change jobs. An employee can still choose their preferred super account (including selecting your default fund) by completing a Choice of fund form. However, if they don’t do this, you’ll need to log in to Australian Taxation Office (ATO) online services and enter their details (including their tax file number) to obtain their stapled fund.

New employees

When setting up a new employee, the process for selecting the right super fund is as follows:

- First, provide a Choice of fund form to your new employee (required).

- If they complete their form, pay their contributions to the super account they nominated.

- If they do not complete their form, you’ll need to obtain their stapled fund using the ATO’s search tool. This step includes employees you don’t need to offer choice to, such as:

- temporary residents

- employees covered by an enterprise agreement or workplace determination.

If your employee doesn’t have a super fund, the ATO will let you know, and you’ll need to open an account for them with your default fund.

Before you can request an employee’s stapled super fund details, you or your authorised representative will need to submit a TFN declaration or a Single Touch Payroll event to establish an employment relationship.

You can provide your new employee with:

You can download the Product Disclosure Statement (PDS) or order printed copies from our Publications order form

Types of contributions

The following table summarises the types of contributions NGS Super can receive and when we can accept them.

| Type of contribution | Age | |

|---|---|---|

| Under 752 | 75 and over | |

| Compulsory SG (paid by employer) | Yes | Yes |

| Mandated non-SG1 (paid by employer) | Yes | Yes |

| Salary sacrifice (paid by employer) | Yes | Limited3 |

| Personal after-tax contributions (paid by member or employer if deducted from pay) | Yes2 | Limited3 |

1 Mandated non-SG refers to contributions payable under an award made, or agreement certified, by an industrial authority.

2 If you're aged 67 to 74 years old, you will be required to meet the work test or work test exemption in order to claim a deduction for a personal superannuation contribution. See our fact sheet Opportunities and limits for super contributions for more detail.

3 If you are 75 years or older, NGS Super can only accept voluntary contributions made before the 28th day after the end of the month in which you turn 75.

Quarterly super guarantee due dates

It's crucial to pay the correct amount of SG by the cut-off date each quarter to avoid paying the superannuation guarantee charge (SGC) to the ATO.

You can make super payments more regularly than quarterly, as long as the total amount you owe each quarter is paid by the due date.

If a payment date falls on a weekend or public holiday, you should make the payment by the next working day.

| Quarter | Period | Payment cut-off |

|---|---|---|

| 1 | 1 July–30 September | 28 October |

| 2 | 1 October–31 December | 28 January |

| 3 | 1 January–31 March | 28 April |

| 4 | 1 April–30 June | 28 July |

This is proposed to change to every pay day from 1 July 2026, however this is not yet law.