Member outcomes assessment

NGS offering

NGS Super members can invest in:

- MySuper: In the Diversified (MySuper) investment option within the NGS Super Accumulation product

- Choice: within the:

- NGS Super Accumulation product (11 investment options)

- NGS Super Transition to Retirement product (11 investment options)

- NGS Super Income Account product (12 investment options).

The Accumulation and Income Account products also include the NGS Self-Managed Direct Investment Option.

The NGS Self-Managed Direct Investment Option will be closing. We expect the closure to be completed prior to 30 June 2025.

Determination for the period ending 30 June 2024

Our performance assessment for the year ending 30 June 2024 is outlined below.

MySuper determination

The Trustee has determined that NGS Super is promoting the financial interests of the Fund’s beneficiaries in relation to the outcomes of the MySuper product. Furthermore, it determined that:

- Members are not being disadvantaged by the scale of the Trustees business operations.

- The operating costs are not inappropriately affecting the financial interests of members.

- The basis for the setting of fees is appropriate for members.

- The options, benefits and facilities offered are appropriate for members.

- The investment strategy, including the level of investment risk and return target, is appropriate for members.

- The insurance strategy is appropriate for members.

- The insurance fees charged do not inappropriately erode the retirement incomes of members.

Choice determination

The Trustee has determined that NGS Super is promoting the financial interests of the Fund’s beneficiaries in relation to the outcomes of the choice product. Furthermore, it determined that:

- Members are not being disadvantaged by the scale of the Trustees business operations.

- The operating costs are not inappropriately affecting the financial interests of members.

- The basis for the setting of fees is appropriate for members.

- The options, benefits and facilities offered are appropriate for members.

- The investment strategy, including the level of investment risk and return target, is appropriate for members.

- The insurance strategy is appropriate for members (Accumulation Account only).2

- The insurance fees charged do not inappropriately erode the retirement incomes of members (Accumulation Account only).2

Annual determination: 30 June 2024

Our strategic objectives have been designed to promote positive member outcomes and support the sound and prudent management of our business operations. The Fund follows sound risk and governance practices, aiming to ensure that member outcomes are not jeopardised by incidents of loss, reputational damage, or inappropriate decision-making. The assessment of our performance is based on these guiding principles.

Key performance areas

Measure and compare products

The metrics for our assessment of the Diversified (MySuper) investment option are prescribed by the Australian Prudential Regulation Authority (APRA). We have assessed our performance against our strategic objectives and member outcomes targets and compared ourselves against other Australian Funds using APRA data.2

For Choice, we have used the data from SuperRatings3 as the basis for our assessment. Investment options were mapped to the most relevant SuperRatings Index, and we compared our returns over 1, 3, 5 and 10-year periods against all options in the relevant index.

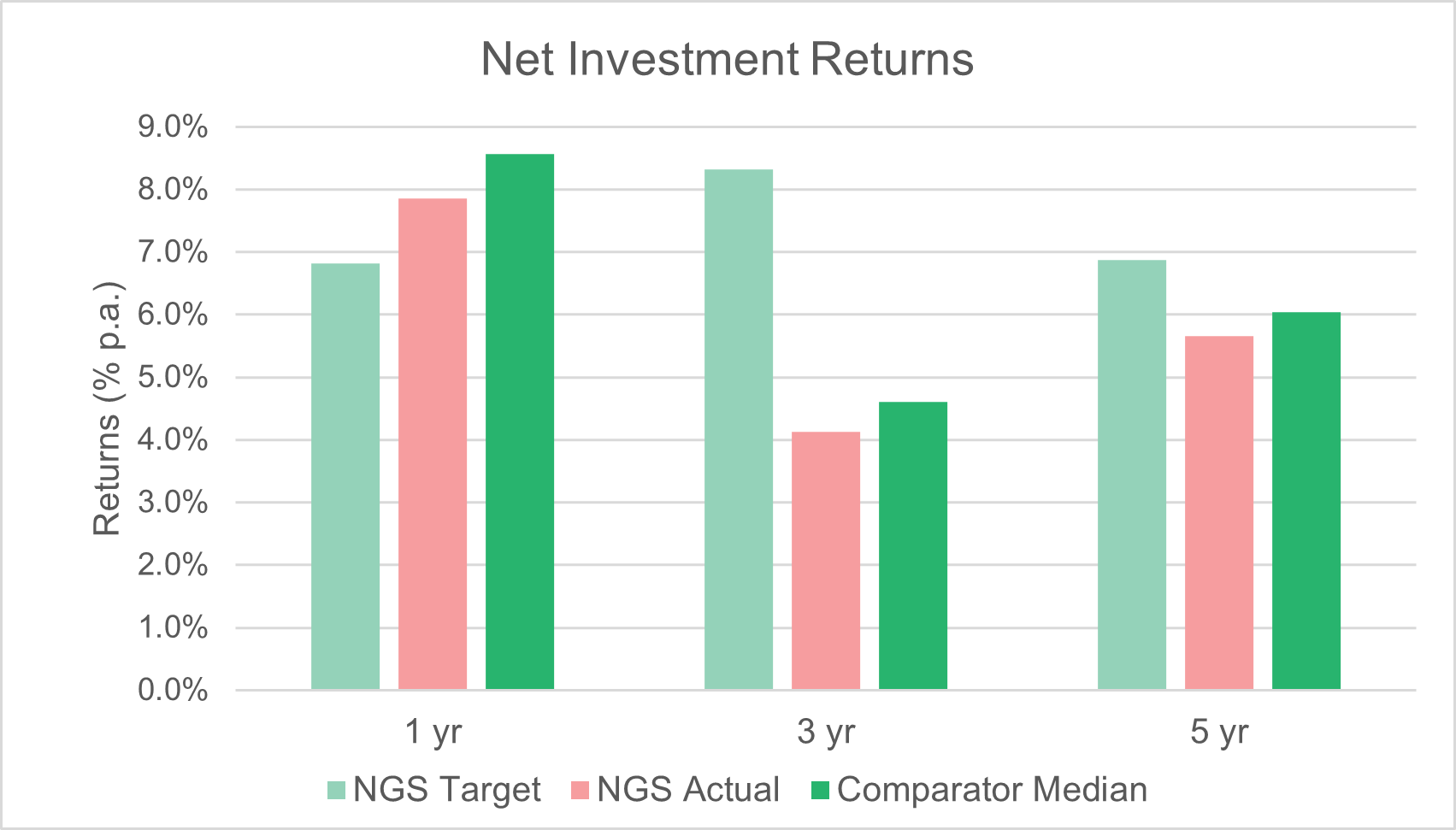

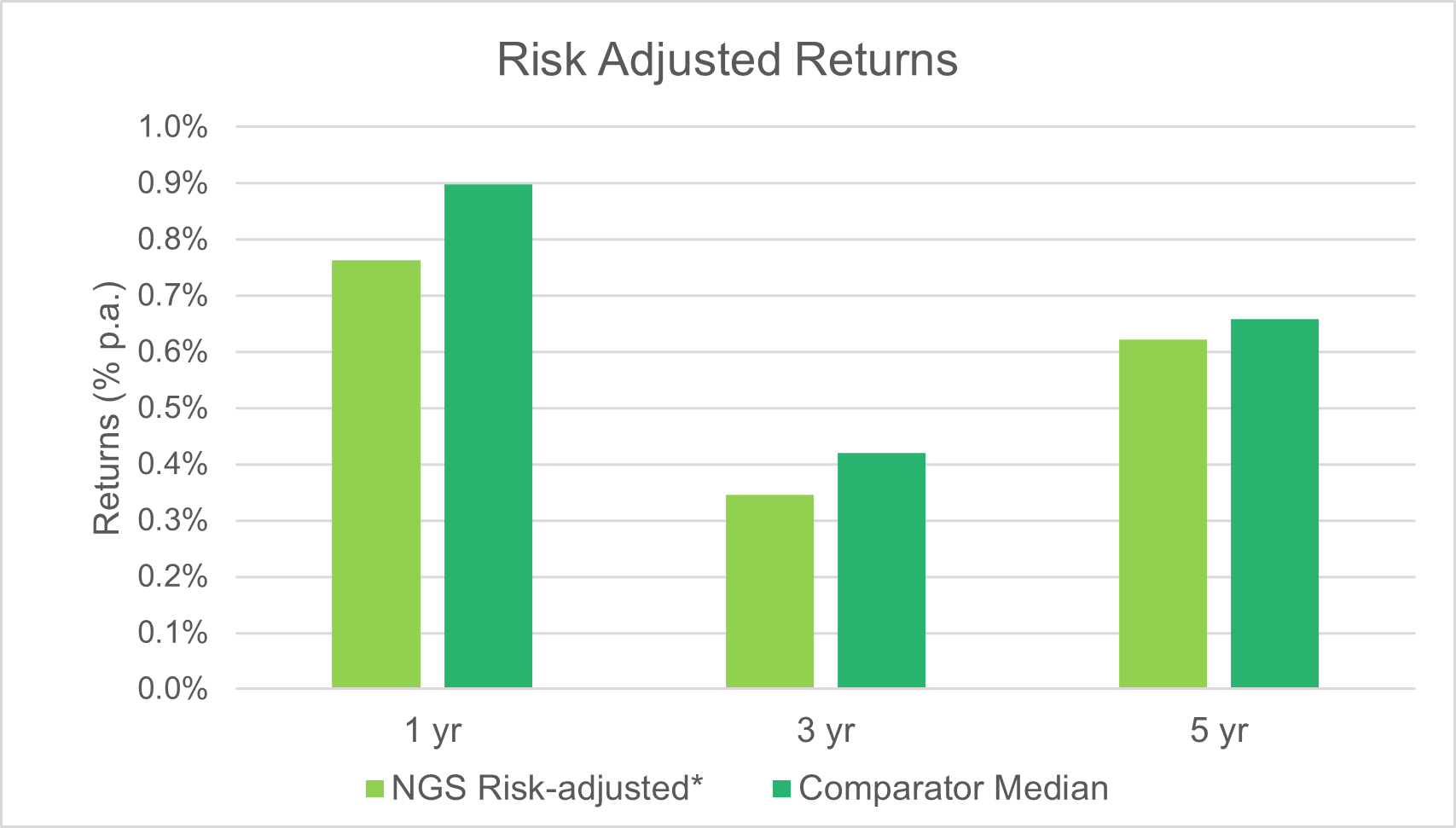

Investment performance

Our objective is to provide investment options to meet a range of member needs, while ensuring that no option has excessive costs or performs inadequately over the longer term.

Diversified (MySuper) investment option

Choice investment options

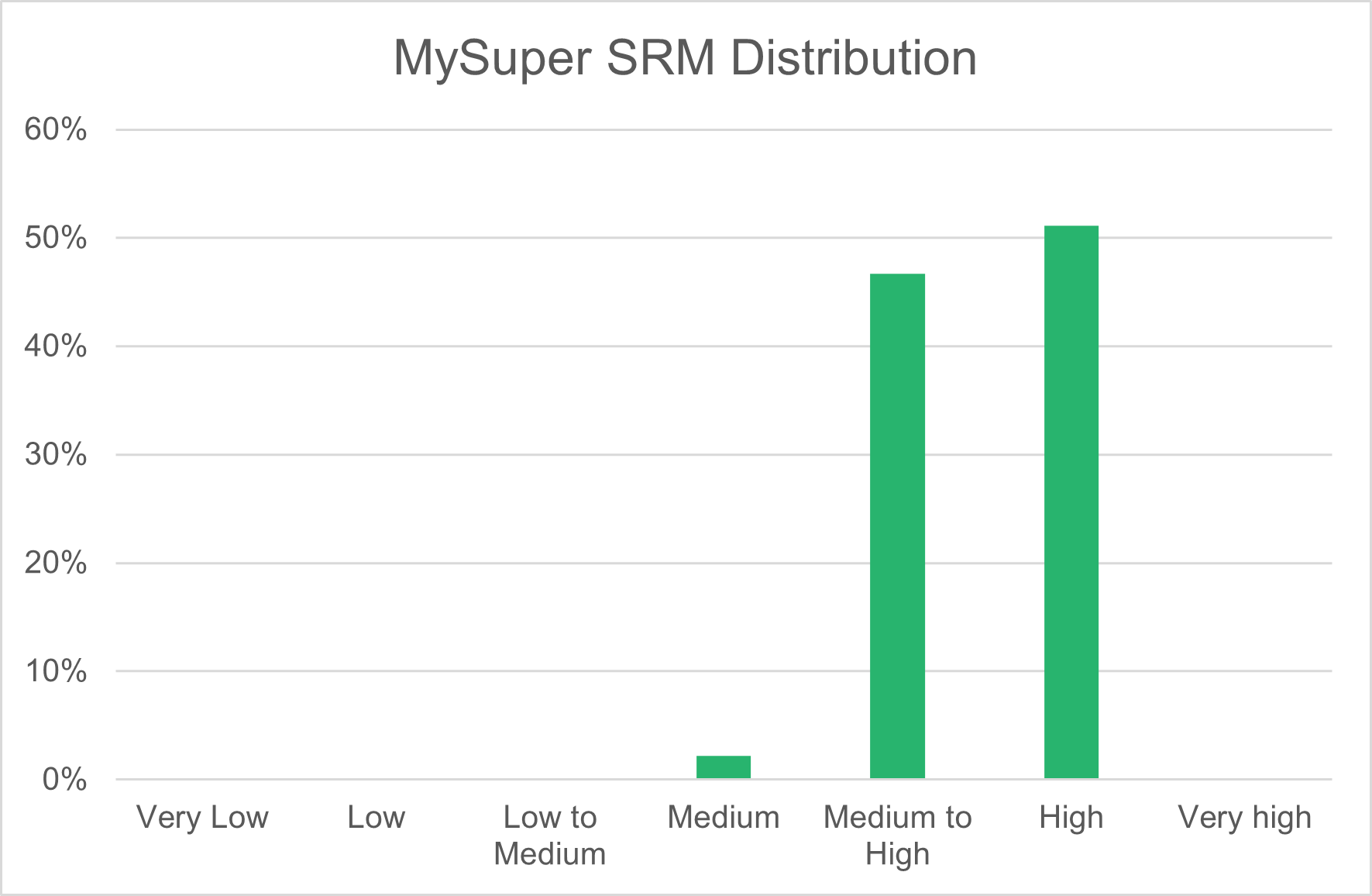

Level of investment risk

We design our investment menu so that members have diversification across asset classes and risk/return profiles. Our options are designed to perform well in the medium to long term, with lower volatility of outcomes in the short term.

Diversified (MySuper) investment option

Choice investment options

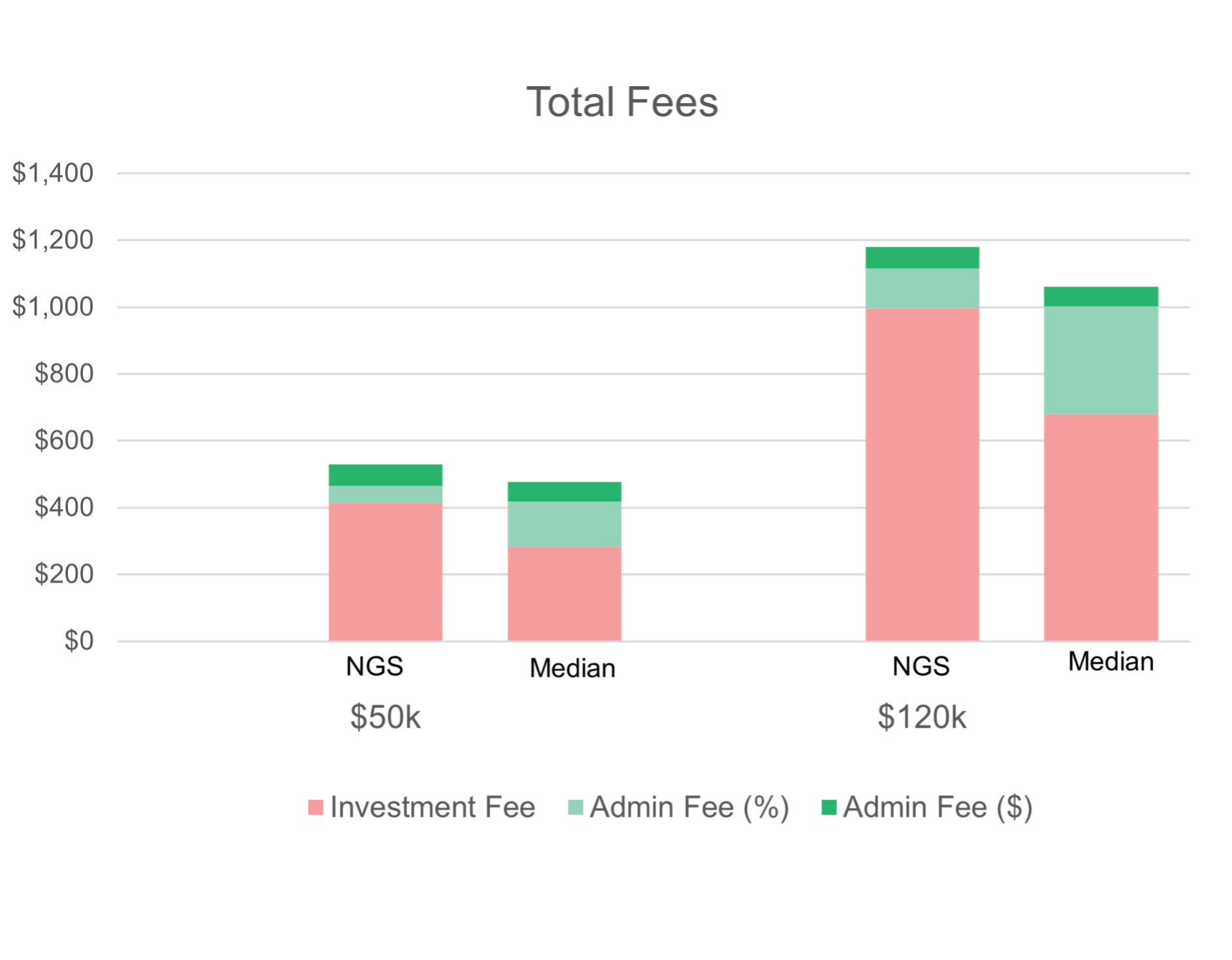

Fees and costs

Our objectives are to provide products and services at a fair cost, and at a fee structure that is sustainable to ensure we can continue to deliver appropriate member services.

Choice investment options

Diversified (MySuper) investment option

Direct Investment Option

Product appropriateness for our membership

We have assessed our performance against our strategic objectives and member outcomes targets and compared ourselves to peer groups using APRA and SuperRatings data. The following assessment factors have been used:

Options, benefits and facilities

Our objective is to ensure that products and services offered are tailored to the Fund’s specific membership. Therefore, NGS Super aims to offer products that provide options, benefits and facilities reflecting the needs of this specific membership, which are integrated and simple to understand and navigate.

We design our products and services to enable our members to get the most from what we offer by ensuring easy access to the information and help they need, at the right time, via their most convenient channel (digital, phone-based and face-to-face). Furthermore, we believe sound financial advice empowers members to make decisions and take actions that lead to better retirement outcomes.

The options, benefits and facilities offered by the Fund are the same for both our MySuper and Choice products.

Key features

As part of the broader member product offering, the Board concludes that the options, benefits and facilities offered by the Fund support the determination that the Fund promotes the financial interests of the beneficiaries.

Investment strategy

The Fund’s suite of investment options have had strategies designed to provide members with choice based on their individual risk appetite and investment time horizon. In addition to the pre-mixed options, members have the building blocks to construct a tailored investment strategy based on personal preferences. This includes access to a number of sector specific options as well as access to a direct investment platform (providing a range of EFTs, Term deposits and direct equity investments)*. Construction of a member’s tailored option may be undertaken by the member or with the assistance of an NGS Super or external financial planner.

The Diversified MySuper option has been designed for the diverse range of NGS members giving consideration to the fund memberships’ age, gender, account balance and expected retirement age distributions. The resulting MySuper investment strategy is expected to achieve growth over the medium to long term that exceeds inflation by more than 3%. Furthermore, the option is diversified across countries, industries, sectors, currencies, and underlying companies and assets to ensure the prospects of achieving returns are not hindered by concentration risk in any one area. This composition reduces the impact of market shocks. The asset allocation is adjusted to accommodate the economic conditions and regularly reviewed to ensure it remains appropriate.

As a default option – the Diversified MySuper option remains appropriate as it provides a good amount of capital preservation qualities whilst also providing exposure to growth over the medium to long term. With fund members more likely to remain within the workforce longer than the average worker and longevity risk increasing, the portfolio must maintain “all weather” properties to help members grow their retirement savings over time, whilst reducing the sequencing risk associated with large market drawdowns.

The full suite of investment options provides members with a range of pre-mixed options to meet different risk preferences, whilst also providing asset class building blocks for members wishing to tailor their options further. The blend of this suite of options and the strategies developed for each option ensure the choice products remains appropriate for our members.

* The NGS Self-Managed Direct Investment Option will be closing. Please see DIO page for more details.

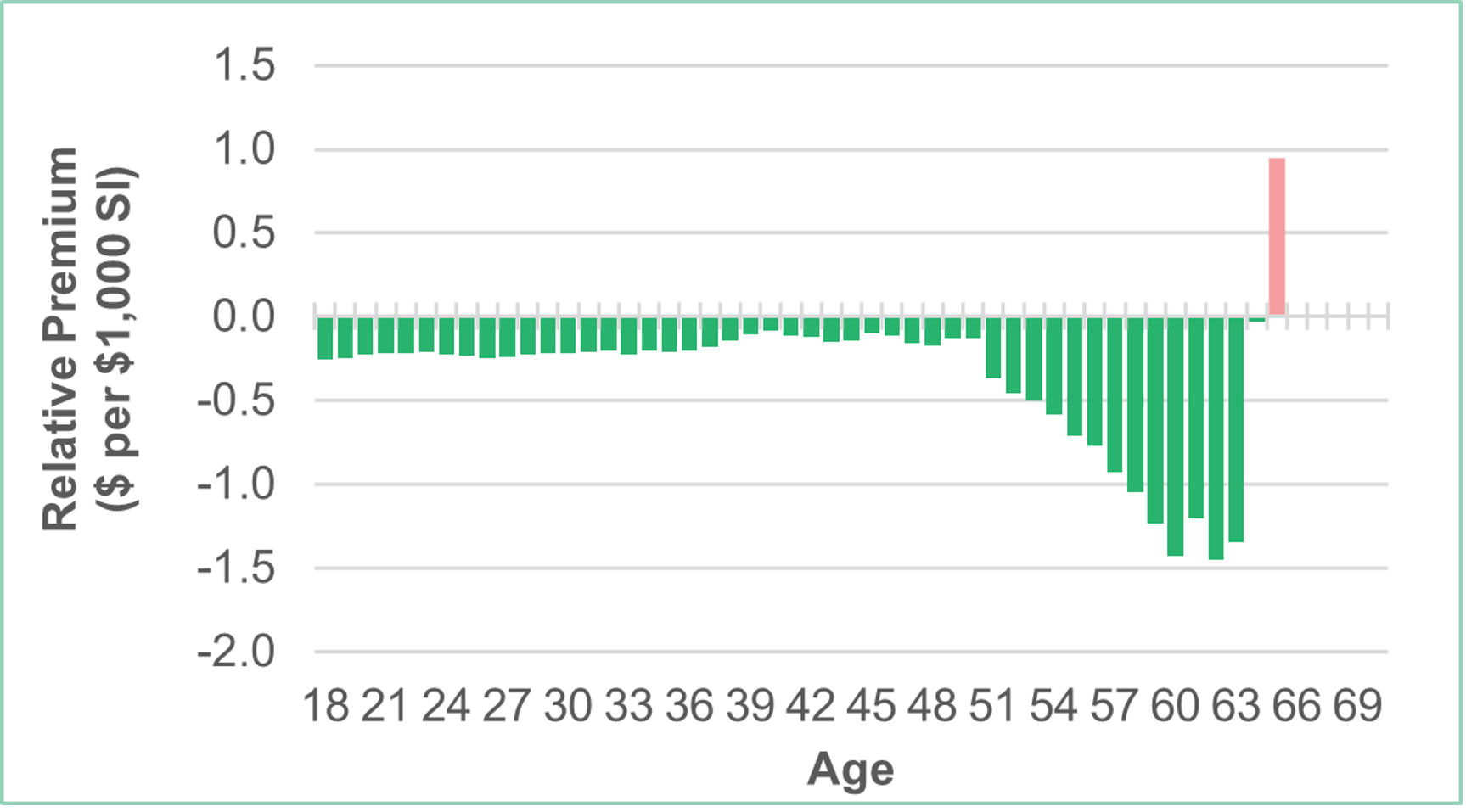

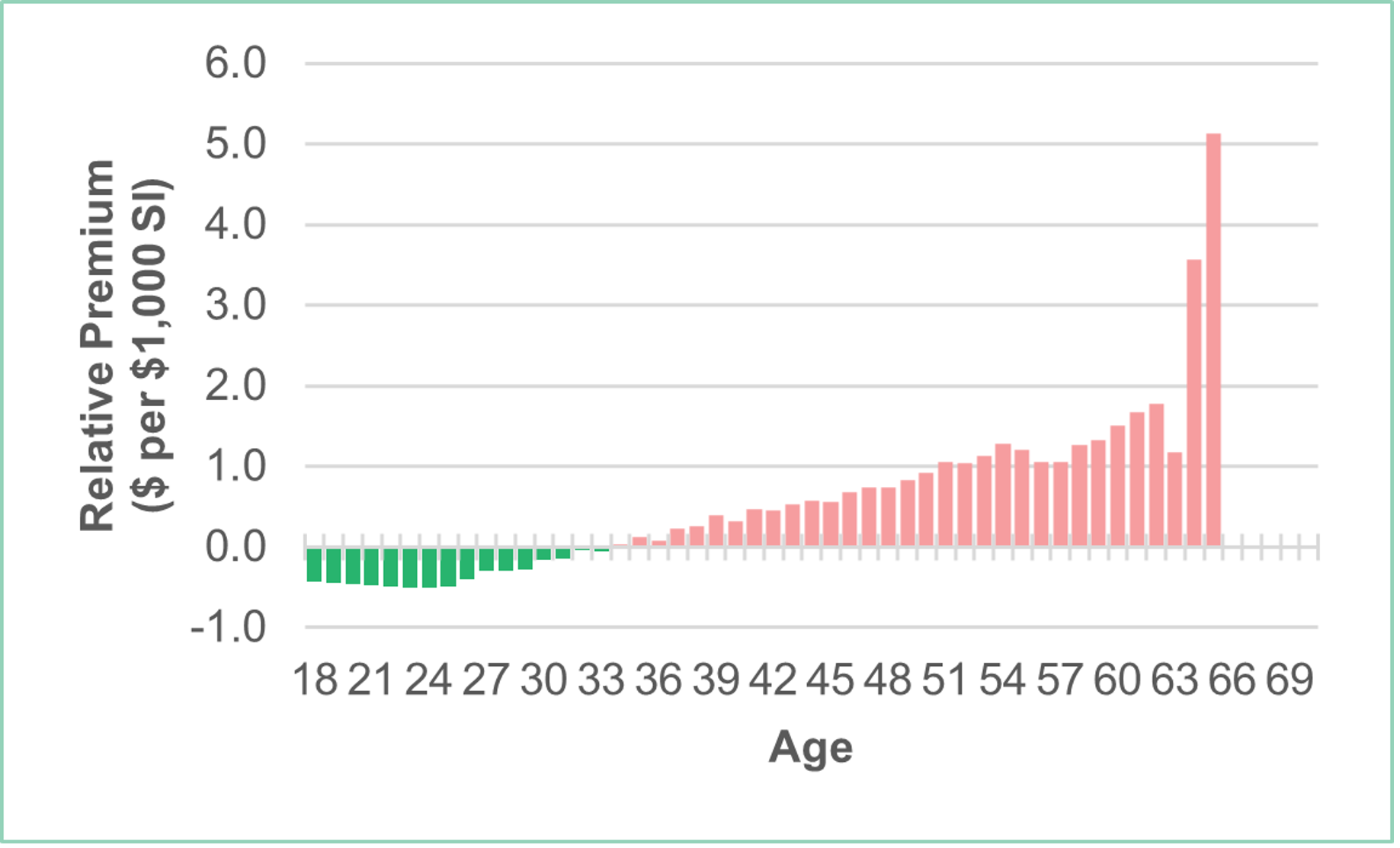

Insurance strategy and premiums

Our objectives are to provide group death, total and permanent disability (TPD) and income protection cover which is appropriate to the needs of our membership, and to offer sustainable premium rates. We strive to be at the forefront of fair, helpful and timely service.

The Fund’s insurance strategy is based on providing an insurance design that:

- reflects the insurance needs and demographics of different groups of members

- aligns to the needs of the target membership, while offering the flexibility for members to tailor cover to their specific needs

- offers Death (including terminal illness), Total and Permanent Disability (TPD) and Income Protection (IP) benefits as a default, and

- balances the cost of premiums with the levels of cover provided, while limiting cross-subsidies between members.

The Fund’s insurance arrangements are the same for both MySuper and Choice accumulation members. For our assessment of the Fund’s default insurance arrangements, we have:

- compared our premiums against other MySuper products based on SuperRatings data; and

- considered whether the premiums paid by our members inappropriately erode retirement benefits.

Premiums comparison for MySuper option

Premiums do not inappropriately erode members' retirement benefits

Scale and operating costs

Our objectives are to seek opportunities to obtain scale advantages through both organic and inorganic growth. We also aim to conduct our operations efficiently, and in a manner which maintains operating costs at a reasonable level for the services provided to members.

The Fund pursues scale to the extent that it provides additional value for members. This value can come in a variety of ways, including cost efficiencies, investment opportunities and hence potential return, and the ability to provide enhanced products or services.

At $15.1 billion in net assets, NGS Super has been able to achieve benefits for members which are not available to members of smaller funds, whilst also being competitive with larger funds. Over the last financial year ending 30 June 2024, NGS Super maintained its administration fees at a time where many other funds (including some of the larger funds) have been increasing fees. During this time, the fund continued to increase its co-investment opportunities, investing alongside large investment managers with no management cost, as well as continue to attract experienced staff who have the capacity to improve the outcomes we deliver to members.At $15.1 billion in net assets, NGS Super has been able to achieve benefits for members which are not available to members of smaller funds, whilst also being competitive with larger funds. Over the last financial year ending 30 June 2024, NGS Super maintained its administration fees at a time where many other funds (including some of the larger funds) have been increasing fees. During this time, the fund continued to increase its co-investment opportunities, investing alongside large investment managers with no management cost, as well as continue to attract experienced staff who have the capacity to improve the outcomes we deliver to members.

As part of the broader member product offering, the Board concludes that the Fund’s scale supports the determination that the products promote the financial interests of the beneficiaries.

NGS Super maintains a competitive operating expense ratio at 0.3% of cashflow – adjusted net assets, aligning to the median for industry funds and all funds. The Funds operating expenses per member ($313) in 2024 were only slightly higher than the median of all funds ($300). Most funds have experienced an increasing trend in this metric, due to the general inflationary impact on operating costs. Increases to operating expenses experienced by NGS Super are in proportion to those experienced by other industry funds.

NGS Super is a niche fund which aims for a high-touch service for members. It is expected that this will have a cost impact. NGS Super has initiated targeted strategies with the aim of continuing to produce scale benefits and contain operating costs per member. Positive member growth has been realised as a result of the Fund’s activities, which should result in lower operating expenses per member.

As part of the broader member product offering, the Board concludes that the Fund’s operating costs support the determination that the products promote the financial interests of the beneficiaries.

Fee strategy

NGS Super aims to provide products and services at a fair cost. We promote internal efficiencies to contain operating costs, whilst accepting higher investment costs through active investment strategies which are directed toward achieving higher net returns.

The Fund has adopted a combination of fixed and asset-based fees, as illustrated on the right for the Diversified (MySuper) investment option. The table below presents NGS Super fees and costs against the comparator median using APRA data as at 30 June 2024 using all MySuper products. Administration fees are applied at the account level, and hence are independent of investment option. Investment fees vary by investment option and are based only on the member assets held in the associated investment option. The Fund’s asset-based administration fee of 0.1% is capped at $500 p.a. (i.e. account balance of $500,000). While there is limited data available regarding the caps applied by other funds, we are aware the range is considerable, from lower to significantly higher than NGS Super’s cap.

The fee charging basis also ensures that no member pays more than 3% of account balance in fees, in line with legislative requirements.

There are a range of factors taken into account in determining the Fund’s fee structure:

- Nature of costs

- Legislative requirements

- Competitive pressure

| Fees and Costs on MySuper Default Option | ||

|---|---|---|

| NGS Super | Comparator Median | |

| Investment Fee | 0.83% | 0.59% |

| Admin Fee | 0.10% | 0.21% |

| Total asset-based fees | 0.93% | 0.80% |

| Admin fees | $65 | $66 |

| Total flat fees | $65 | $66 |

In FY23, a Fee Structure Assessment was completed to ensure that the efficiencies of the changed administration operating model will be shared with the right cohorts of members in the right ways (including likely fee reductions for a number of member cohorts).

In FY25, the proposed fee structure changes will be applied as the administration operating model transition draws closer to completion.

Investment performance

1 The NGS Self-Managed Direct Investment Option will be closing. We expect the closure to be completed prior to 30 June 2025.

2 As insurance is only available in accumulation products, this assessment excludes consideration of Transition to Retirement and Income accounts.

3 The reference to APRA data relates to APRA Quarterly MySuper and/or APRA Annual Fund-Level Superannuation Statistics as at 30 June 2024.

4 SuperRatings data as of 30 June 2024. SuperRatings specialises in ratings, research and consulting, providing the superannuation industry with the tools and intelligence required to build value for their members and create a stronger super industry that benefits all Australians. For more information go to www.superratings.com.au.

5 APRA Quarterly MySuper data as at 30 June 2024 was used to compare MySuper products.

6 APRA Quarterly MySuper data as at 30 June 2024 was used to compare MySuper products.

7 Source: SuperRatings investment fee information to 30 June 2024.

8 Based on APRA Annual Fund-level Superannuation Statistics June 2024.

.png?lang=en-AU&width=600&height=332)

.png?lang=en-AU&width=600&height=363)