Carbon Neutral 2030 (CN2030) progress report as at 30 June 2023

04 Jun 2024 10 min readIn 2021, NGS Super (Fund) set a target to deliver a carbon neutral1 investment portfolio for our Diversified (MySuper) investment option by 2030.2 In 2022 we made the further decision to set an interim target of a 35% reduction in carbon emissions 3 from our original baseline4 by 2025.

We committed to updating the membership annually on:

- progress towards the targets set

- how this progress plots on the Fund’s carbon neutral glide path through to 2030 while being transparent about any adjustments which become apparent through the annual review process, and

- re-evaluate scenario analysis5 annually.

30 June 2023 carbon intensity results

Carbon intensity of the Diversified (MySuper) investment option at 30 June 2023

The Fund measures the carbon intensity6 in our portfolio by measuring the number of tonnes of carbon dioxide (or its equivalent) emitted per millions of dollars (AUD) invested. Results for the financial year ending 30 June 2023, showed that the carbon intensity of the Diversified (MySuper) investment option fell to 27 tCO2e/AUD million invested.

Table 1 below illustrates the carbon intensity calculations of the Diversified (MySuper) investment option from 2021 – 2023. At least half of the reduction has come from the Australian shares sector, while the rest is split between international shares, property, private equity and infrastructure sectors.

| June 2021 (tCO2e/AUD million invested) Baseline measurement7 |

June 2022 (tCO2e/AUD million invested)8 | June 2023 (tCO2e/AUD million invested)9 | |

|---|---|---|---|

| Diversified (MySuper) scope 1 and 2 emissions | 48.0 | 38.0 | 27.4 |

| % change on prior year | N/A | -20.83 | -27.89 |

Table 1 – Carbon intensity of Diversified (MySuper) investment option and % change

Updated glide path through to 2030

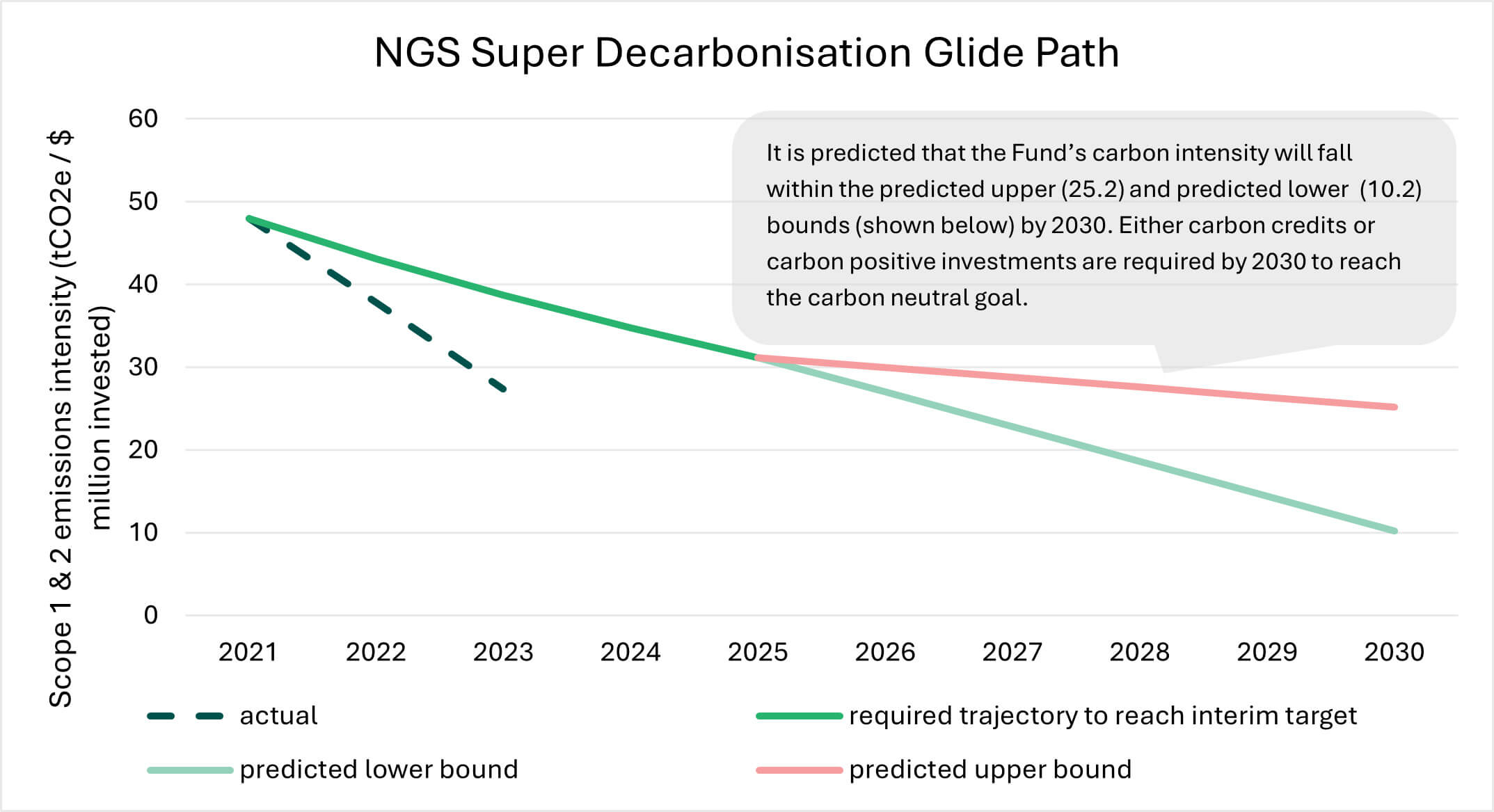

The Graph 1 below plots the 30 June 2023 carbon intensity of the Diversified (MySuper) investment option on the Fund’s glide path for both our 2025 interim target10 and our end target11 of delivering a carbon neutral Diversified (MySuper) investment option by 2030. The dark-green dotted line illustrates the 43% reduction12 in carbon intensity achieved since we began our measurements in 2021.

Graph 1 - The Fund’s Diversified (MySuper) option decarbonisation glide path

While the glide path has been presented as linear, the transition to the low-carbon economy, and the Fund’s pathway, is not expected to be linear. There will be ups and downs along the way, as many companies and industries may see an increase in carbon intensity as they develop more sustainable low-carbon operating models. Graph 1 has been prepared based on current information and assumes no change to external factors such as (but not limited to) geopolitical factors, changes to law and/or policies and practices of government, government and/or regulatory bodies.

Re-evaluation of scenario analysis

The Fund updated its climate scenario analysis as of 30 June 2023 which saw the completion of physical and transitional scenario analysis based on the Network for Greening the Financial System Net Zero 2050, Delayed Transition and Nationally Determined Contributions scenarios.13 This analysis covered approximately 80% of the Funds’ assets under management.

A summary of the key findings from the scenario analysis will be published in the Fund’s updated Taskforce on Climate-related Financial Disclosures report effective 30 June 2023.

Members’ best financial interests is paramount

As we work towards our carbon neutral target for the Diversified (MySuper) investment option, acting in the best financial interests of our members is always our first consideration. If at any point it becomes clear that meeting the target could jeopardise returns, we will adjust our target and/or timeframes and communicate this accordingly.

Important information

The information in this update has been prepared by NGS Super Pty Limited (ABN 46 003 491 487, RSE Licence L0000567 and AFSL 233 154) (NGS Trustee) the trustee of NGS Super (ABN 73 549 180 515) (NGS Super). It is general information and may not be right for you. Please read the Product Disclosure Statement and Target Market Determination to decide if NGS Super is right for you.

The information in this update is accurate as of Thursday 13 June 2024.

The historical information used in this update is not necessarily a guarantee of future performance. Further, this update contains “forward-looking statements”. Forward-looking statements are subject to risks, uncertainties and assumptions about investments made by the Fund and the environment in which they operate. As such, the forward-looking statements are not guarantees or predictions and may change. Care should be taken before relying on such statements.

The external links used in this update are for information purposes only. The NGS Trustee has no direct control over the content of linked sites. Links to external websites are not an endorsement or recommendation of the material on those sites.

How we measure carbon intensity

Introduction

This section outlines how we calculate the scope 1 and 2 carbon intensity of our Diversified (MySuper) investment option hereafter referred to as “portfolio”. This is a technical document and is provided for the information of interested members to provide transparency.

In 2021, NGS Super (Fund) set a 2030 target for a carbon-neutral investment portfolio.14 This meant that we needed to complete a baseline measurement of the carbon intensity of the portfolio, and make the same measurement annually to understand our rate of decarbonisation and how we are tracking against both our 2030 end target and our 2025 interim target (a 35% reduction in carbon intensity based on 30 June 2021 levels).

From year to year, there will be amendments to the calculation methodology as we become more sophisticated in our calculation capabilities and as better information becomes available.

The measurement

Which emissions?

When the Fund calculates the carbon intensity of the investment portfolio, we are calculating the scope 1 and 2 emissions attributed. These are deemed in scope emissions. At this stage we are not considering scope 3 emissions as part of our carbon-neutral goal and therefore this measurement methodology does not consider scope 3 carbon emissions of the Fund’s investments, however, the stranded asset risk due to high scope 3 emissions is considered as part of our exclusions.

The unit of measurement

We acknowledge that there are 2 generally accepted methodologies to measure the carbon intensity, which are:

- Intensity per $million invested: (scope 1 + scope 2 emissions) x $million invested / Enterprise Value Including Cash (EVIC), or

- Intensity per sales: (scope 1 + scope 2 emissions) / $million in sales.

There are positives and negatives for both measurements. The Fund has adopted the first methodology as it allows us to compare our entire portfolio, which is invested in diverse asset types.

The Fund defines carbon intensity as the tonnes (t) of carbon dioxide (CO2) equivalent per million dollars (AUD) invested and displays this as tCO2e15/$million invested (AUD).

This can also be referred to as “financed emissions”, which are the indirect greenhouse gas emissions attributable to The Fund as a financial institution due to its involvement in providing capital or financing to the original emitter.

Acknowledging the data challenges

While climate change isn’t a new investment risk, the data we need to measure carbon intensity is emerging. For The Fund to measure the carbon intensity of its portfolio, we need access to the scope 1 and 2 carbon emissions of the investments within our portfolio. For listed companies, The Fund mainly relies on carbon emissions data provided by the Fund’s ESG data provider.

Scope 1 and 2 emissions from our investments are not always available. Therefore, estimation will be required for companies and/or assets which do not report scope 1 and scope 2 emissions. Our methodology is to accept the scope 1 and 2 emissions reported by the company/investment in the first instance, and only apply estimates where there is no reported figure as at the estimation date. We also take the last reported figure available at the time of performing the calculation.

As soon as investment and/or asset reported scope 1 and 2 emissions data becomes available, we will include these in subsequent calculations, overriding any prior estimation. We acknowledge that this may artificially inflate or deflate our subsequent calculations, depending on whether our previous estimation was over or understated. However, we acknowledge that data perfection is not possible and do not consider that an excuse for inaction. It is also inappropriate to exclude investments that don’t report scope 1 and scope 2 emissions from our overall calculation as this is not a fair representation of these emissions within the investment portfolio.

Transition path and emissions attribution

Given the data challenge, coupled with the transition trajectories of certain high-emission but vital sectors, we acknowledge that both our transition and the overarching economic transition to the low-carbon economy will not be linear. We do not expect a neat year-on-year reduction in our portfolio emissions or those of our investee companies as we head towards our 2030 target. For some sectors in the economy, it may take longer for emissions to fall, or they may even rise in the short term, due to the technological innovation and transition required to enable those sectors to operate in the low-carbon economy.

Given we adopt the ‘Intensity per $million invested’ methodology, we acknowledge that this carbon intensity measure is subject to market volatility. A company may be reducing its emissions, but if the value of the company falls significantly due to adverse market movements, then the carbon intensity measure will increase.

We will investigate and interrogate outliers in terms of increased carbon intensity to ensure that the increase is justifiable and for the greater good in transitioning to the low-carbon economy.

Each year, we undertake an attribution of any reduction or increase in the NGS financed emissions to understand their drivers. This provides us with the opportunity to take action.

What is included in our calculation?

Almost all of the Fund’s investments within the portfolio as at the calculation date (30 June) each year is deemed ‘in scope’. This includes co-investments.

However, not all investments report their actual scope 1 and 2 emissions. NGS and/or any appointed data provider may apply estimates for investments that:

- have not reported scope 1 and 2 emissions data

- are deemed immaterial (in terms of value).

For portfolios of listed securities, we estimated the portfolio’s emissions by taking the average of the investment managers’ holdings (every quarter end) over the year.16

Actual Asset Allocation (AAA) for MySuper Diversified as at 30 June 2023

The AAA for Diversified (MySuper) investment option as at 30 June 2023 (below) is used for the calculation of option’s carbon intensity.

| Sector | AAA of Diversified (MySuper) at 30 June 2023 |

|---|---|

| Australian shares | 24.15% |

| International shares | 28.26% |

| Listed property | 0.10% |

| Listed infrastructure | 0.04% |

| Property | 10.95% |

| Infrastructure | 9.98% |

| Private equity | 8.18% |

| Bond alternatives | 8.55% |

| Corporate bonds | 2.06% |

| Other | 7.73% |

| Total | 100.00% |

What isn’t included in our calculation?

Cash and term deposits, Commodities, foreign exchange overlays, and derivatives outside Australian and International shares asset classes are deemed out of scope. The reason is that investment in these assets does not involve physical processes or industrial activities that release greenhouse gases.

The table below provides a summary of the Fund’s asset classes/sectors and whether they are included in the carbon intensity calculation for the Diversified (MySuper) investment option and illustrates the percentage of the calculations based on reported data and estimates.

| Asset class | Sector | In scope | % of the assessment based on reported data | % of the assessment based on estimates17 |

|---|---|---|---|---|

| Australian Shares | Australian Shares | Yes | 78% | 22% |

| International shares | International Shares | Yes | 75% | 25% |

| Listed property | Listed property | Yes | 70% | 30% |

| Listed infrastructure | Listed infrastructure | Yes | 82% | 18% |

| Property | Property | Yes | 29% | 71% |

| Infrastructure | Infrastructure | Yes | 26% | 74% |

| Private equity | Private equity | Yes | 0% | 100% |

| Alternatives | Liquid alternatives | No | n/a | n/a |

| Alternatives | Commodities | No | n/a | n/a |

| Fixed income | Bond alternatives | Yes | 0% | 100% |

| Fixed income | Corporate bonds | Yes | 85% | 15% |

| Fixed income | Government bonds | No | n/a | n/a |

| Cash | Cash and term deposits | No | n/a | n/a |

Australian Shares, International Shares and Corporate Bonds (Fixed Income), Listed Property and Listed Infrastructure

Calculation methodology

The Fund subscribes to carbon data from and ESG data provider and uses this data and associated methodology to calculate the carbon intensity of the Australian shares, international shares and corporate bond portfolios. The ESG data provider classifies carbon emissions per Greenhouse Gas (GHG) Protocol.

We use enterprise value including cash, i.e., market capitalisation (market cap) plus both short and long-term debts as the calculation basis. As mentioned earlier, an ESG data provider is used to source emissions data. Bloomberg and RIMES are used to source market cap and debt data in order to calculate the tCO2e/$million invested (AUD).

Estimates and proxies

Where companies report their scope 1 and 2 emissions, the ESG data provider will reflect that reported company data in the system. It should be noted that there are many protocols (audited and unaudited) for companies to use to calculate their scope 1 and 2 emissions. The ESG data provider will report what company has reported first and foremost. We acknowledge that this lacks consistency, but it is the industry norm.

Where companies do not report their emissions, the ESG data provider performs estimation based upon several models developed by the ESG data provider’s research team. The ESG data provider’s estimation allows for use of three models, choosing the best model for the disclosed data available. The three models are:

- Production model – mainly used for power-generating utilities

- Company-specific intensity model – used where there is past reported emissions data (but not data available for all years)

- Industry segment-specific model – used for other companies and involves determining a company’s emissions based on other companies within their segment.

When emissions data for a company was missing from the ESG data provider’s data, the average intensity for the company’s sub-industry was used. Outliers were omitted for the purposes of calculating industry averages for the Australian, international shares and corporate bonds sectors.

An outlier was defined as any emission datapoint that was larger than the 3rd quartile of emissions for the sub-industry plus 1.5 times the interquartile range.

For the Australian and international share sectors, where there was a derivative based on an equity index, the notional equivalent in the underlying company holdings was used.

For example, a swap on $100 million notional of the ASX50 TR Index is replaced with the weighted holdings in the 50 underlying stocks for the purposes of the emissions calculation.

Infrastructure and Property (unlisted)

Calculation methodology

For financial year 2023 calculation, the Fund sources scope 1 and scope 2 of its in-scope private or unlisted assets directly from investment managers and/or asset and where this is not available, we apply estimates as outlined in previous “What is included in our calculation?” section of this document.

We acknowledge that each investment manager or asset operator will have its own methodology or process to calculate scope 1 and scope 2 emissions which introduces data variability. This is a known limitation to the methodology.

Estimates and proxies

Where investment managers and/or asset operators were unable to provide scope 1 and scope 2 data, the Fund will apply an estimate. There are three agreed methods for applying estimates within the unlisted portfolio:

- For assets with like characteristics (i.e. airport v airport), the basis for the estimates applied can be based on other like assets (with reported data) within the portfolio.

- If there are no like or comparable assets within the reported data, or the reported data is deemed flawed, sector averages can be applied to the investments/assets.

- When no accurate fit between assets in the portfolio is found, a listed proxy is used.

Note: “Flawed” data in this context suggests that there are discrepancies in the emissions data, which do not align with reported figures or the known characteristics of the asset/ sector.

In the Fund working files for each calculation, we record the details of the estimate basis used.

Private equity and Bond alternatives

For private equity’s carbon intensity calculation, we are using look-through information provided by our custodian bank to estimate/proxy emissions. Specifically, our custodian conducts analysis to identify the listed equivalent sub-industry for each asset; from there, we will use the sub-industry average number for carbon emission proxy of that particular asset.

Methodology changes since the last reported carbon intensity figure

30 June 2021 was the baseline carbon intensity calculation.

Each year investments may fluctuate between having reported figures and unreported figures where estimates or proxies need to be applied by the Fund, and/or a data provider. These changes are not considered to be a change in methodology.

Changes to calculation methodology from 2022 to 2023

From 2022 to 2023, there are three main changes to our calculation methodology which were discussed throughout the paper. Firstly, we use average Australian and international equity managers’ holdings throughout the year to estimate their carbon intensity. Secondly, we use custodian provided look-through information for estimating carbon emissions for private equity and bond alternatives. Finally, we utilize the actual asset allocation as at 30 June, instead of the dynamic asset allocation, to calculate the carbon intensity of the Diversified (My Super) option.

1 Based on scope 1 and scope 2 emissions.

2 The term ‘portfolio’ throughout this article refers to the Diversified (MySuper) investment option.

3 Based on scope 1 and scope 2 emissions.

4 The baseline measurement was completed as at 30 June 2021.

5 The Fund completes scenario analysis at sector level. As at 30 June 2023 approximately 80% of the total Fund’s assets underwent a form of scenario analysis. The analysis completed was based on a mixture of actual asset information and or holdings and analysis of sectors using proxy data.

6 Refer to How we measure carbon intensity for more information on how we measure carbon intensity.

7 Refer to How we measure carbon intensity for more information on how we measure carbon intensity.

8 Refer to How we measure carbon intensity for more information on how we measure carbon intensity.

9 Refer to How we measure carbon intensity for more information on how we measure carbon intensity.

10 35% less emissions on the 2021 baseline level.

11 Carbon neutral Diversified (MySuper) investment option by 2030.

12 The percentage change = (27.4 – 48) divided by 48.

13 These are scenarios developed by the Central Banks and Supervisors Network for Greening the Financial System (NGFS). The NGFS is a group of central banks and supervisors that exchange experiences, share best practices and contribute to the development of environment and claim risk management in the financial sector and mobile mainstream finance to support the transition toward a sustainable economy.

14 Diversified (MySuper) option.

15 tCO2e is tonnes of carbon dioxide equivalent. This is a measure that includes all greenhouse gases and brings them back to a common unit of measure, allowing comparison.

16 In 2022, we used the dynamic asset allocation (DAA) as at 30 June. In 2023 it was determined that taking the average holdings of our equity investment managers over the year provides a better estimate of the portfolio’s emissions rather than a point-in-time estimate.

17 The total % of estimates is 52%.