Carbon neutral by 2030: Member update 2023

16 Jun 2023 10 min readWe have entered a decisive decade for humanity, as the effects of climate change (and the lack of action taken to ameliorate it) have become increasingly obvious worldwide. Economic systems will face major disruption and we must make a paradigm shift in our economic models to protect our members’ retirement savings. In 2021, NGS Super made the bold decision to transition our investment portfolio to carbon neutral by 20301. In early 2022, we confirmed that this target is achievable. It requires us to complete more work, especially around carbon-positive investments to sequester carbon, such as natural capital, and carbon capture utilisation and storage (CCUS)2. We also need to better understand the factors that may affect how carbon markets evolve, such as regulation, liquidity and transparency.

As a Fund, we recognise that this is the moment in history in which we must take drastic action to contribute to change. By using the collective capital of committed NGS members, we will support companies building sustainable, lower carbon businesses, while aiming to improve on current average long-term investment returns for our members.

Each year, we complete analysis to re-review the carbon intensity of the Fund and scenario analysis to track how we are moving towards our targets (2025 and 2030) and to understand any new or changed risks under our chosen scenarios.3 We also complete analysis to ensure that our targets are achievable in the best financial interests of members.

This update covers the following:

What have we done since March 2022?

What does this work tell us?

What does decarbonisation look like for NGS Super?

Reporting and feedback

Members’ best financial interests remain paramount

What have we done since March 2022?

Since our last update to members (published in May 2022), we have been focusing on 3 main streams of work:

- making changes to the portfolio4 to make it more carbon-efficient5

- completing a review of the work completed in 2021:

a. remeasuring the carbon emissions for the portfolio

b. revisiting the scenario analysis for the listed assets

c. revisiting scenario analysis in the form of proxy’s representing the Fund’s infrastructure and property sectors - assessing where we are on our “glide path” through to our stated targets at 2025 and 2030, ensuring that there is still a reasonable likelihood of meeting our carbon neutral target by 2030.

What has resulted from the re-review of the portfolio at 30 June 2022?

Carbon emissions as at 30 June 2022

Since our 30 June 2021 measurement of carbon intensity6 at the Diversified (MySuper) option level (the portfolio), we have seen an approximate 20% reduction in carbon intensity.

How are we tracking on our glide path?

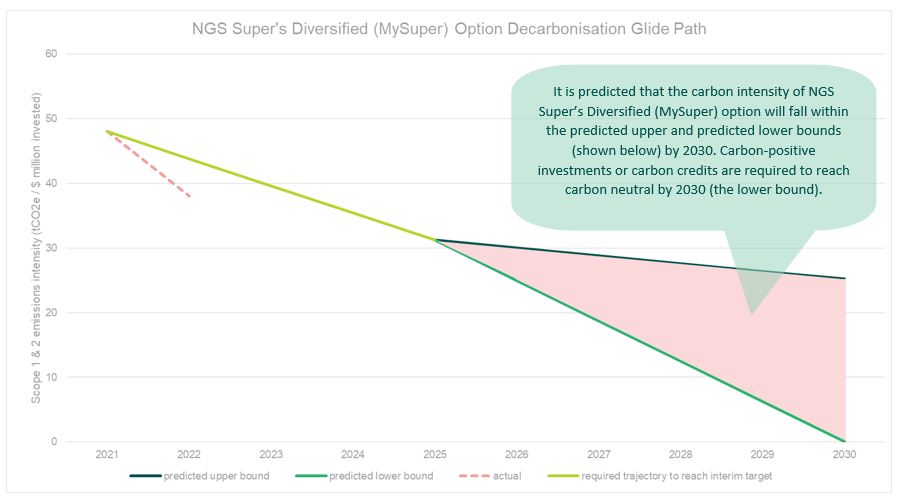

Figure 1 below shows how we are tracking along our glide path to our 2025 interim target8 and 2030 end target.9 As at 30 June 2022, we have managed an approximately 20% reduction in carbon intensity, around 13% ahead of the required trajectory.

Figure 1: NGS Super glide path as at 30 June 2022

While the glide path looks linear, it should be noted that the transition to the low-carbon economy, including NGS’s own pathway, will not be linear. There will be ups and downs along the way, as many companies and industries may see an increase in carbon intensity as they develop more sustainable low-carbon operating models.

Carbon credits and/or positive carbon investments

The carbon credit market is evolving. In our 2022 update we noted that first and foremost we will be looking to reach our targets without the use of carbon credits or offsets. However, as more research emerges, it becomes clear that there is a valid place for carbon credits as the world transitions to the low carbon economy — where these carbon credits are from credible projects and are accounted for in a robust way.

Carbon-positive investments are investments that can generate a return as well as negate or remove carbon from the atmosphere. These are things like carbon capture and storage (also known as carbon sequestration), direct air capture, land regeneration projects and timber or forestation projects. We continue to evaluate opportunities in these spaces.

Attribution of the carbon reduction

It is important to understand the drivers of the reductions achieved, so we have completed an attribution analysis. The results are shown in Table 1 below.

| Source of reduction | Approximate percentage reduction (%) | Explanation |

|---|---|---|

| Asset allocation | 15% | While the strategic asset allocation of the Diversified MySuper investment option is a long-term allocation, NGS Super manages the dynamic asset allocation (which is within the strategic asset allocation ranges) to position the portfolio for the shorter term. Some sectors are more carbon intensive than others. These changes have accounted for approximately 15% of the carbon reduction. |

| Actions from internal Investments team | 37% | The following actions from the internal Investments team accounted for approximately 37% (in aggregate) of the carbon reduction:

|

| Improvements to calculation methodology | 49% | Each year, we will review the methodology we use to calculate the carbon intensity of the portfolio. The aim of this is to reflect the carbon intensity of the portfolio more accurately. You can review the documented methodology for 30 June 2022, including what changed from the 2021 to the 2022 calculation. |

Scenario analysis

What did we learn?

It is important to conduct scenario analysis while transitioning to a carbon-neutral investment portfolio because it can help to:

- identify key risk within the investment portfolio, allowing us to implement an action plan through either divestment or engagement and

- understand where opportunities lie to invest in the solutions for climate change — we want to invest in climate solutions.

As at 30 June 2022, we re-reviewed our scenario analysis on 3 scenarios available to NGS Super: Delayed Transition 2 degrees (Disorderly); Net Zero by 2050 (Orderly) and Nationally Determined Contributions (NDCs) (Hot House World). These scenarios are developed by the Network for Greening Financial System (NGFS) which align with integrated assessment models used by the Intergovernmental Panel on Climate Change (IPCC). The results look at the impact on value from 2022 through to 2050. This was completed for Australian shares, international shares, property, infrastructure, and private equity.

For Australian shares and international shares, the scenario analysis was completed on our portfolio as at 30 June 2022. For property, infrastructure, and private equity the 30 June 2022 scenario analysis was based on listed proxies using the same 3 scenarios.

You can find details of the 3 scenarios in the appendix at the end of this article.

We will outline our key findings and takeaways from the scenario analysis in the Fund's updated Task Force on Climate-Related Financial Disclosure report later in 2023.

What does this work tell us?

The re-review has resulted in us gaining confidence that we can make significant progress towards our interim target of 35% less emissions by 2025 and become carbon neutral by 2030 while acting in the best financial interests of members.

What does decarbonisation look like for NGS Super?

Our plan for decarbonisation from now until 2025, and then on until 2030 will include:

- engagement

- divestment

- investing in carbon-positive investments.

Engagement

If we have a company or investment that has high scope 1, 2 or 3 emissions, and we can see that they have a sound and realistic business plan to transition to the low-carbon economy within a timeframe deemed acceptable to the Fund (taking into consideration industry trends and the overall global target of net zero by 2050), we will take an engagement approach.

We will regularly meet with the relevant company and/or investment manager to ensure they are progressing with their transformation business plans while still delivering value to the Fund. NGS Super also leverages the deep engagement work performed by Australian Council of Superannuation Investors (ACSI) and Federated Hermes EOS which help us on ESG engagement with listed companies (both Australian and international equities).

NGS Super’s target of carbon neutral by 2030 is an ambitious one, and we are aware that not all those companies we invest in today may be net zero by this time. But we are willing to accept companies with some level of scope 1 and 2 emissions at 2030 and beyond provided they are genuinely transitioning to the low-carbon economy, pose no transition risk, and we are obtaining acceptable risk-adjusted returns from these investments.

At 2030 we envisage that we will have investments that:

- have low or justifiable scope 1 and 2 emissions

- are carbon-neutral or

- are carbon-positive, offsetting those investments within the portfolio at point (1).

Divestment

In our 2022 update, we noted that we were starting our divestment assessment and program. Effective 30 June 2022, we expanded our exclusions to include companies in the oil and gas exploration and production sector.10 This means that we restrict any holdings with companies:

- that generate more than 30% of their revenue from the distribution, power generation, or extraction of thermal coal or

- who are in the oil and gas production and exploration sector.11

It is important to note that while our exclusion position does not cover every company involved in oil and gas exploration and production, it focuses on those businesses for whom those activities are focused on upstream oil and gas operations — bringing with it more risk of value destruction (stranded asset risk).

Have these divestments affected investment returns?

In short, no. We have in fact reduced our portfolio’s exposure to climate change transition risk.

On the performance side, Figure 2 below illustrates the performance of the following key indices from 30 June 2022 to 31 December 2022:

- ASX300

- ASX300 less the companies on NGS Super’s exclusion list

- The NGS Australian equity sector.

Figure 2: ASX300 and NGS Super AEQ performance from 30 June 2022

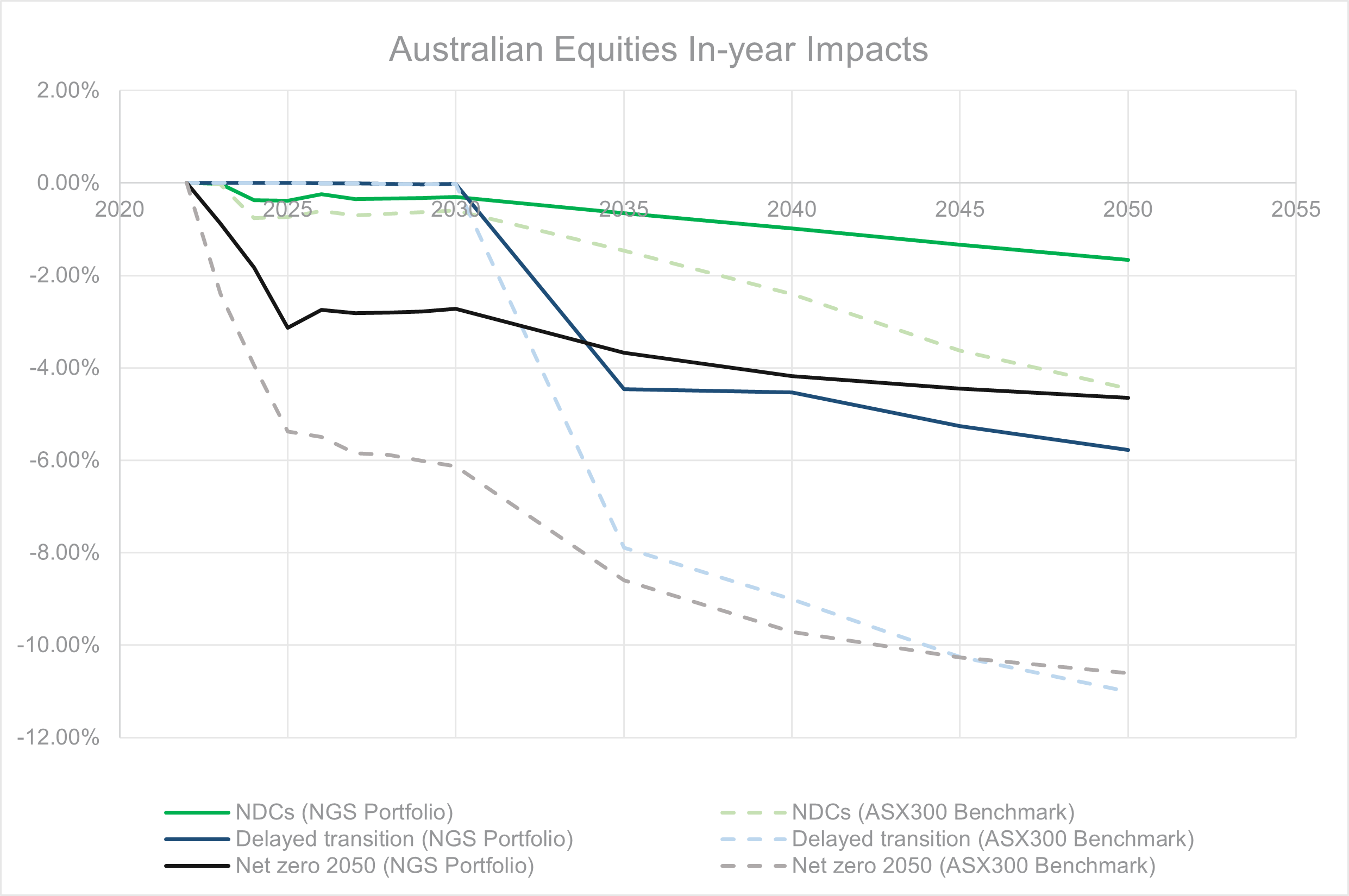

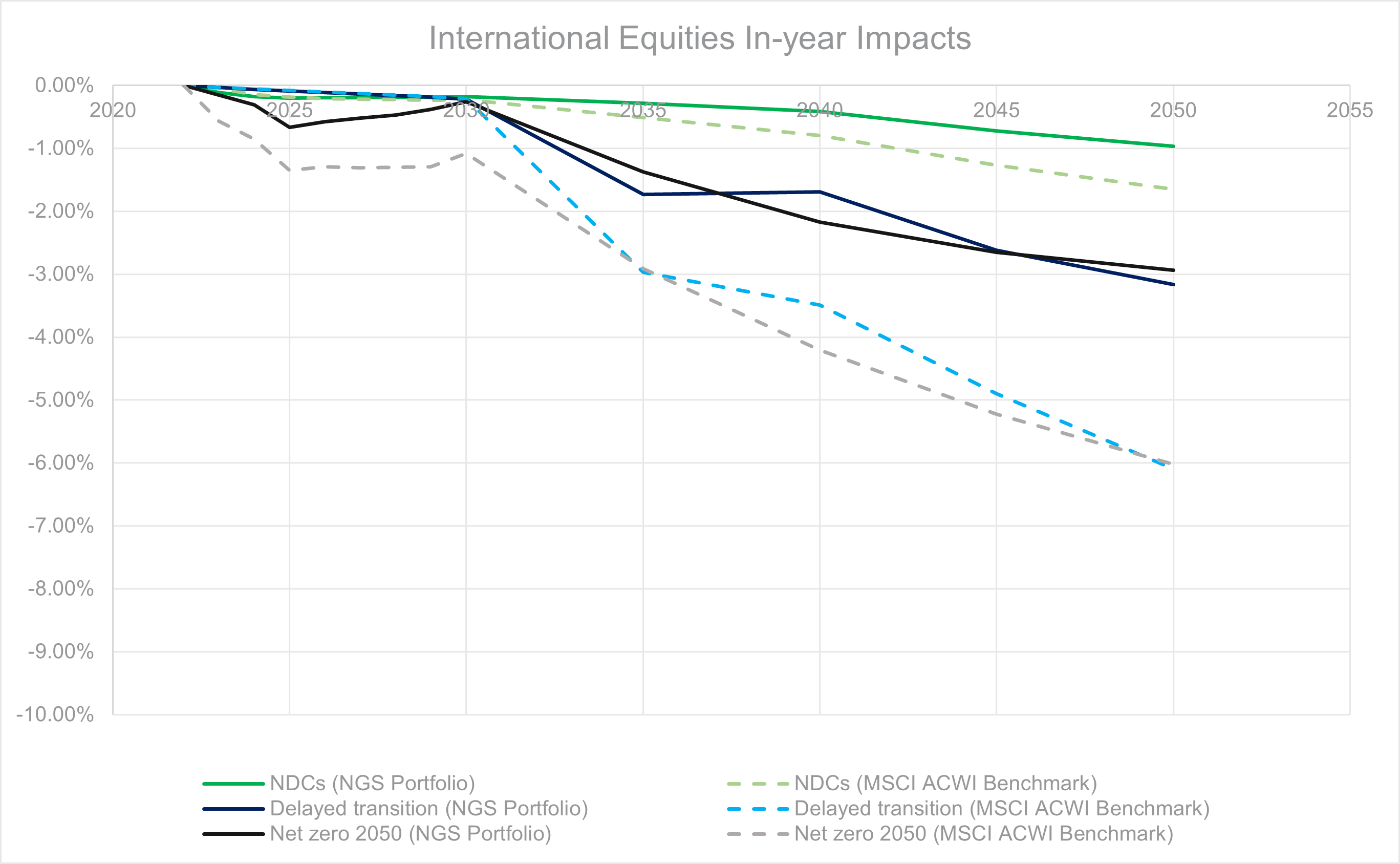

On the risk side, Figures 3 and 4 below show that under our selected scenarios, the NGS Super Australian and international equities portfolios are much less sensitive to valuation adjustments if we were to see these climate scenarios play out. This provides evidence that the actions taken around our exclusions have reduced the portfolio’s exposure to stranded asset risk.

Figure 3: NGS Super Australian Shares portfolio versus selected scenarios.

Figure 4: NGS Super International Shares portfolio versus selected scenarios.

Investing in carbon-positive and low-emission investments

We have been seeking out what we deem to be carbon-positive (see above) and low-carbon investments within our portfolio, and we will continue to do so. Carbon-positive investments are investments in things like carbon capture and storage (also known as carbon sequestration) and timber or forestation projects.

Low-emission investments are investments that promote solutions for the transition to the low-carbon economy. Examples include (but are not limited to):

- renewable energy generation and distribution

- low-carbon energy generation and storage

- green bonds (financing initiatives to combat climate change).

Here is a snapshot on the positive impact investments made in the 2021 calendar year. The 2022 snapshot will be released soon.

Reporting and feedback

Each year, we commit to report on our progress against our new interim target12 and the end goal of a carbon neutral investment portfolio by 2030. Each year we will:

- re-measure the carbon intensity of the portfolio and track progress

- re-evaluate the scenario analysis findings and

- reassess the Fund’s glide path analysis and pathway to a carbon neutral investment portfolio by 2030 and adjust as necessary.

Members’ best financial interests remain paramount

Acting in the best financial interests of our members is the paramount duty for the Trustee and will always be the first consideration as we embark on our decarbonisation journey and at each annual progress review. If at any point it becomes clear that we may be jeopardising our members’ best financial interests, we will adjust our goals and timeframes accordingly.

Appendix 1: Scenarios

NDCs (2.6 degrees) — Hot House World

NDCs includes all pledged policies even if not yet implemented.

This scenario assumes that the moderate and heterogeneous climate ambition reflected in the conditional NDCs at the beginning of 2021 continues over the 21st century (low transition risks). Emissions decline but lead nonetheless to 2.6 degrees Celsius of warming associated with moderate to severe physical risks. Transition risks are relatively low.10

Delayed Transition (1.6 degrees) — Disorderly Transition

Delayed Transition assumes global annual emissions do not decrease until 2030. Strong policies are then needed to limit warming to below 2 degrees Celsius. Negative emissions are limited.

This scenario assumes new climate policies are not introduced until 2030 and the level of action differs across countries and regions based on currently implemented policies, leading to a “fossil recovery” out of the economic crisis brought about by COVID-19. The availability of CDR technologies is assumed to be low pushing carbon prices higher than in Net Zero 2050. As a result, emissions exceed the carbon budget temporarily and decline more rapidly than in Well-below 2 degrees Celsius after 2030 to ensure a 67 % chance of limiting global warming to below 2 degrees Celsius. This leads to both higher transition and physical risks than the Net Zero 2050 and Below 2 degrees Celsius scenarios.11

Net Zero by 2050 (1.4 degrees) — Orderly Transition

Net Zero 2050 is an ambitious scenario that limits global warming to 1.5 degrees Celsius through stringent climate policies and innovation, reaching net zero CO₂ emissions around 2050. Some jurisdictions such as the US, EU and Japan reach net zero for all greenhouse gases by this point.

This scenario assumes that ambitious climate policies are introduced immediately. CDR is used to accelerate the decarbonisation but kept to the minimum possible and broadly in line with sustainable levels of bioenergy production. Net CO₂ emissions reach zero around 2050, giving at least a 50% chance of limiting global warming to below 1.5 degrees Celsius by the end of the century, with no or low overshoot (greater than 0.1 degrees Celsius) of 1.5 degrees Celsius in earlier years. Physical risks are relatively low but transition risks are high.12

Appendix 2: How we calculate the carbon in our portfolio

1 Scenario analysis refers to the scenario analysis completed by NGS Super facilitated by Planetrics PlanetView platform. We use the scenario framework which consists of 6 scenarios representing orderly transition, disorderly transition and a hot house world. In this communication we illustrate summary analysis using 3 of the 6 scenarios being 1) Delayed 2 degrees (Disorderly) 2) Net Zero 2050 (Orderly) and 3) Nationally Determined Contributions (NDCs) (Hot House World). These scenarios are developed by the Network for Greening Financial System (NGFS) which align with integrated assessment models used by the Intergovernmental Panel on Climate Change (IPCC).

2 Portfolio means Diversified (MySuper) investment option.

3 Based on scope 1 and scope 2 emissions.

4 35% less emissions on the 30 June 2021 baseline level.

5 Carbon neutral for the Diversified (MySuper) investment option.

6 climatepromise.undp.org/news-and-stories/what-are-carbon-markets-and-why-are-they-important

7 As defined by the Global Industry Classification Standard (GICS).

8 For listed investments, as defined by the GICS sub-industry; for unlisted investments, an internal assessment is made.

9 35% less emissions in the Diversified (MySuper) investment option as at 30 June 2025 (when compared to the 30 June 2021 emissions measurement).

10 www.ngfs.net/ngfs-scenarios-portal/explore

11 www.ngfs.net/ngfs-scenarios-portal/explore

12 www.ngfs.net/ngfs-scenarios-portal/explore