Investing 101: Introduction

26 Apr 2021 4 min readThis article is the first in our new series Investing 101, which will cover the basics of investing. We’ll start by explaining how NGS Super invests your retirement savings.

What we’re investing each day

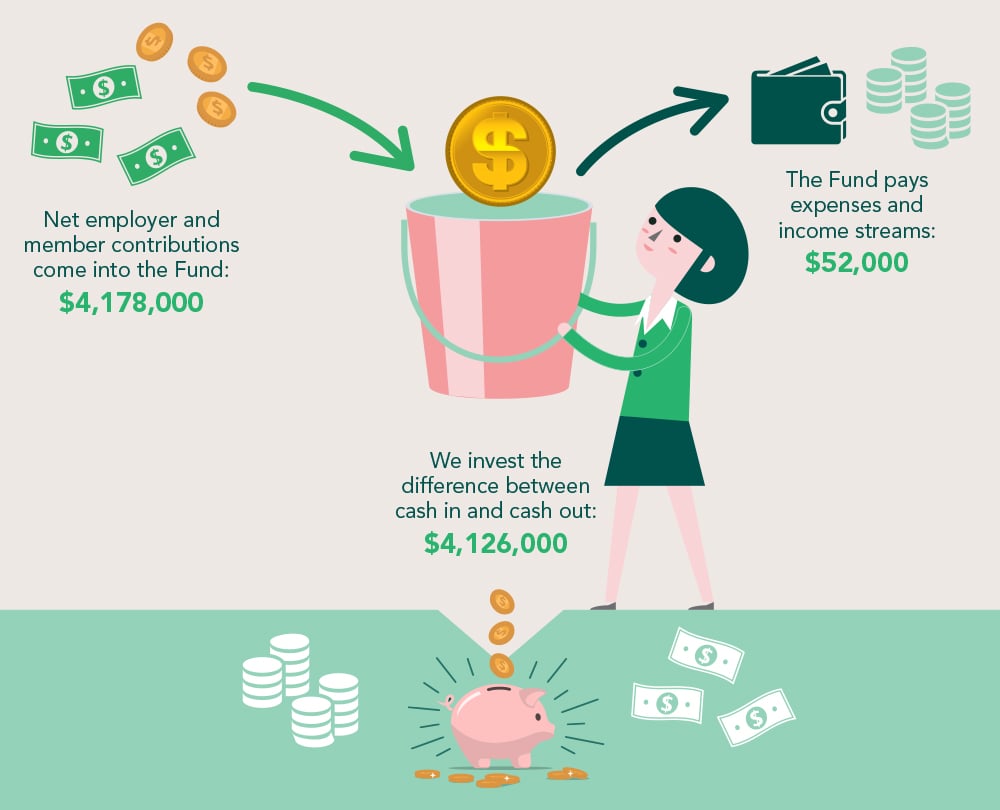

Our investment approach starts with cash. Each business day we review the cash balances of the Fund — contributions from members and employers come in, and we compare these against payments due out for income streams or expenses. The difference between the 2 numbers is the amount that needs to be invested. NGS reviews cash balances daily so that we get members’ money working hard as quickly as possible.

Example: 1 December 2020i

Asset classes and investing

Asset classes are the building blocks of investment options. You’ve probably heard of many of the types of asset classes we hold, show in the table below.

| Cash and term deposits | Government bonds | Corporate bonds |

| Bond alternatives | Growth alternatives | Property |

| Australian equities (shares) | Infrastructure | International equities (shares) |

For each of our investment options, we have what’s called asset allocation, which just means how much of each asset class we aim to have in that particular option. (For an example of asset allocation, you can see the breakdown for our Diversified MySuper option.)

When the NGS Investments team is determining how to invest the newly contributed cash, we compare the actual allocation to each asset class with the expected allocation.

If, for example, we decide to put the excess cash into Australian equities, we transfer it to one of the investment managersii we’ve appointed for that asset class. The investment manager then buys equities on the stock exchange on our behalf.

Measuring performance

An essential part of managing your money is measuring the performance of our investments. To do this, we need to ensure we have independent and accurate valuations. NGS has recently moved to daily unit pricing, which means that we value all the individual assets in every asset class, on a daily basis.

We recalculate the valuation of each investment, and issue it to our members through a single unit price for each product. That means we’re calculating valuations for 2100 different securitiesiii held on 42 stock exchanges around the world,iv with 77 high-conviction investment managers, in 40 currencies!v

The breadth of our investment range is a conscious strategy to give our members the benefits of investment diversification.

This is complex, but calculating our daily valuations allows us to make decisions with the most recent data. In times of market turmoil, we have reliable and accurate data from all assets in the world, to enable us to manage our portfolio well. It also allows us to allocate new cash efficiently, to the asset classes that merit additional investment.

i Figures are approximate and for illustrative purposes only.

ii We’ll provide more information about investment managers and how we work with them in an upcoming article.

iii State Street Priced Positions report, downloaded 22 February 2021.

iv NGS Fund Market List 12 February 2021.

v State Street Priced Positions report, downloaded 22 February 2021