A note from our Chief Investment Officer

06 Apr 2020 Ben Squires, Chief Investment OfficerInvestment cycles are an unavoidable part of investing. A look back through history provides many examples of similar impacts to what we are experiencing in markets today. The cause of each market downturn tends to differ, which means that it’s difficult to predict the turning points in any particular market cycle.

This current downturn has been triggered by a health crisis which has resulted in a significant amount of uncertainty around the future supply and demand of goods and services globally. Although we can understand this rationally, this knowledge doesn’t make us feel any better when we are in the midst of a downturn — it’s been proven that the emotional impact of uncertainty and loss is much stronger than the emotional response we feel from market gains. When you throw in concerns about health risks, impacts of social isolation and employment, it’s not surprising that the desire to take action, to just ‘do’ something, is greater than ever.

In past market downturns, such as the Global Financial Crisis (GFC), we saw many members switching out of single sector and multi-asset class options after markets had already experienced the worst of the downturn, and subsequently switching back to these options after markets had largely recovered the worst of those losses. The impact of such decisions was incredibly destructive to long-term wealth creation; that same applies today. As such, I encourage you to speak with the Fund if you are considering switching investment options at this time.

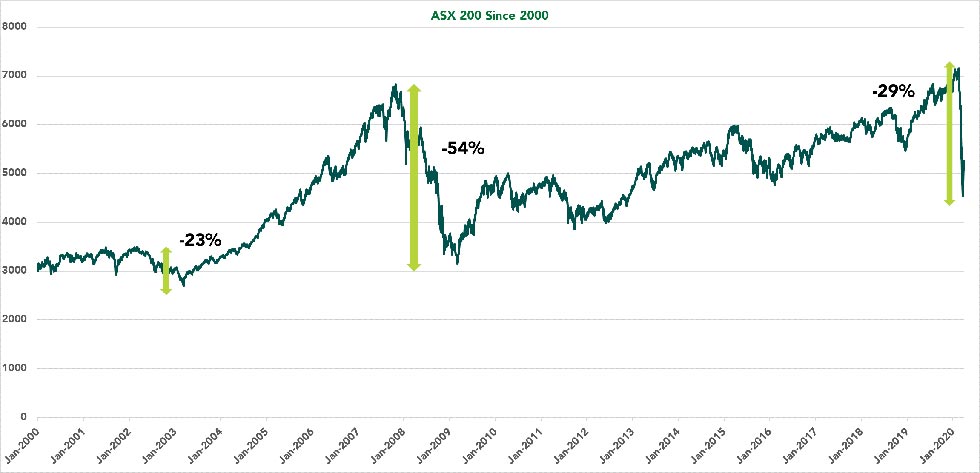

The following chart shows the performance of the ASX 200 index from the year 2000 to 3 April 2020. Large falls in markets occurred during the early 2000 technology bubble and the 2008 GFC. In comparison, the current correction has seen the market fall 29% which represents approximately 86% of the falls witnessed in the GFC and is more than that experience in the 2000 technology bubble.

As at 31 March 2020, the one year performance of the NGS Super Diversified MySuper option was -2.61%, while the ASX 200 has dropped 29% in the last few weeks. Investing in one of the NGS Super diversified investment options means that you gain exposure to a portfolio that is designed to weather all market cycles — in other words, the portfolios are designed with diversified holdings to achieve the stated investment objective over time, while reducing volatility of returns. Our internal investment team, along with a panel of advisers and professional investment managers, navigates the investment cycle by using various indicators to adjust the exposure to risk when the return potential provides inadequate compensation for the risk being taken. The managers that we invest with have managed money through multiple market downturns and are well equipped to respond to changing economic conditions; they have strong risk mitigation approaches incorporated in their investment strategies.

It is also important to remember the following in relation to your super:

- Super is a long-term investment and over the long term performance remains strong within the Fund. Although not immune to the economic slowdown, our portfolios have been designed to weather market downturns.

- The vast majority of assets impacted by the downturn will fully recover, recouping all losses across the portfolio over time.

- Avoiding making investment switch decisions at this time, and instead allowing the Fund to alter the asset allocation within options, will enhance your return over the long term. Timing markets is an extremely hazardous approach as it is difficult to identify turning points in advance.

As previously mentioned, the portfolios have large holdings in cash and fixed income assets and are well positioned to take advantage of attractive opportunities as they arise. Unless the global economy is entering a depression, the market has already priced in a lot of bad news, so any decision to switch at this point will result in selling out closer towards the bottom of the market.

History has shown that the coordinated action by central banks and government to support businesses and financial markets that we are currently seeing will provide fertile grounds for an economic recovery. We continue to remain conservatively positioned across the portfolio given the uncertainty and duration of social distancing measures and the impact to economic activity. The active approach to portfolio management has provided a good degree of cushioning from the worst affected areas in markets and this provides a greater ability to take advantage of improving economic conditions.

I wish you and yours all the best through this difficult time.