Sustainability

NGS Super secular trends: the hydrogen economy

15 Aug 2023

5 min read

Each year, our Investments team sets the strategic asset allocation for our portfolio. As part of this exercise, we produce an in-depth research piece on upcoming “secular trends”.

What are secular trends and why do they matter?

Secular trends are evolving trends in the market that take place over a longer time horizon, rather than being seasonal or cyclical. It’s important for us to understand secular trends when we’re reviewing and setting our long-term strategic asset allocation, as they help us identify investment opportunities and risks.

Key trends ahead

Our secular trend analysis this year looked at:

- carbon neutrality

- electronic and autonomous vehicles

- 3D printing

- the metaverse

- demographic changes

- quantum computing

- geopolitics

- blockchain, decentralised finance and cryptocurrency

- the hydrogen economy.

This article focuses on the hydrogen economy.

The hydrogen economy

Hydrogen is the most abundant element in the universe. It can be burned to produce heat or it can be put through a chemical process to produce electricity, and in both instances the only byproduct is water. However, hydrogen doesn’t exist in pure form on Earth — it has to be produced from other compounds, and the conversion to pure hydrogen itself takes energy. It’s probably most useful to think of hydrogen as an energy carrier (storage) than an energy source.

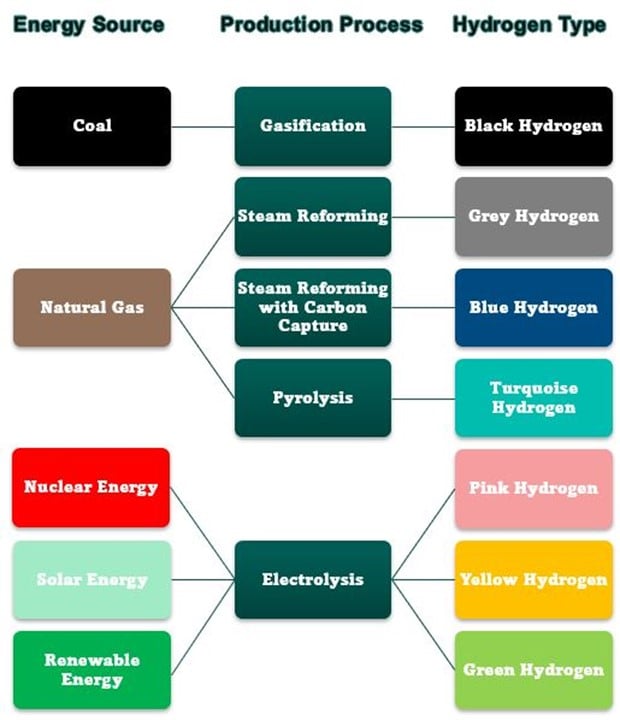

You may have heard hydrogen described with reference to colours. These identify the source of the hydrogen, and the process used to produce it:

Green hydrogen, where hydrogen is produced from renewable energy sources, has the potential to significantly reduce global CO2 emissions, and while it is currently more expensive than both blue and grey hydrogen, it is expected to be cheaper by 2030.1 It could play a significant role in the decarbonisation of industries that have been difficult to decarbonise, including heavy duty vehicles and heavy industries (such as steel and cement production).

The main challenges facing green hydrogen are transmission, distribution and storage. While there is extensive research and development in the area, McKinsey estimates that an investment gap of US$165 billion remains in this area.

Are there risks?

As noted above, safe transportation and storage of hydrogen are a supply chain risk, but these risks will be avoided in industrial hub settings that are close to the production location. From an investment perspective, it will be important to continue to monitor the development of technologies, rates of adoption and the growth of renewable energy sources, as these will all have an impact on the viability and uptake of green hydrogen.

From a competitive perspective, successful development of a cost-efficient battery could threaten green hydrogen’s expected role in the transport sector.

The fact that Saudi Arabia, a top crude oil exporter, is focusing on becoming a top supplier of hydrogen,2 seems to indicate that geopolitical risk may not be significant.

What does this mean for NGS Super’s portfolio?

Green hydrogen is a type of hydrogen fuel produced using renewable energy sources like solar, wind, and hydropower. This production process ensures that green hydrogen does not generate greenhouse gas emissions or contribute to climate change. Its versatility as a clean energy source means that it can be used in various sectors, such as transportation, power generation, and industrial processes, with promising technological advantages.

At NGS, we are committed to investing in renewable energy, and green hydrogen is a key component of our investment strategy. By investing in green hydrogen, we are not only contributing to a more sustainable future but also increasing our exposure to green infrastructure and technological development. This will significantly aid our fund's goal of achieving Net Zero Carbon by 2030.