Investment

The real cost of switching in volatile investment markets

16 Jun 2022

8 min read

We understand that investing, staying focused and holding steady in times like these can be tough.

Financial markets are trembling due to recent geopolitical tensions and unprecedented high inflation. Equity markets have depreciated from their all-time high, fixed income assets have posted negative returns, and the price of oil has soared. Watching all this volatility, it may have crossed your mind to switch your superannuation investment options.

‘Panic selling’, the informal term for the wide-scale selling of investments, is most likely to occur during periods of volatile price movements, as investors overreact to negative information or events. If the investment goal of selling or switching to a more defensive investment option is to avoid large losses, does this actually work?

We have analysed two significant historical market events1 that featured extreme volatility and determined that switching from a high-risk investment option (Diversified (MySuper)) to a low-risk option (Cash), can see you worse off in the long term. Let’s take a look at the analysis.

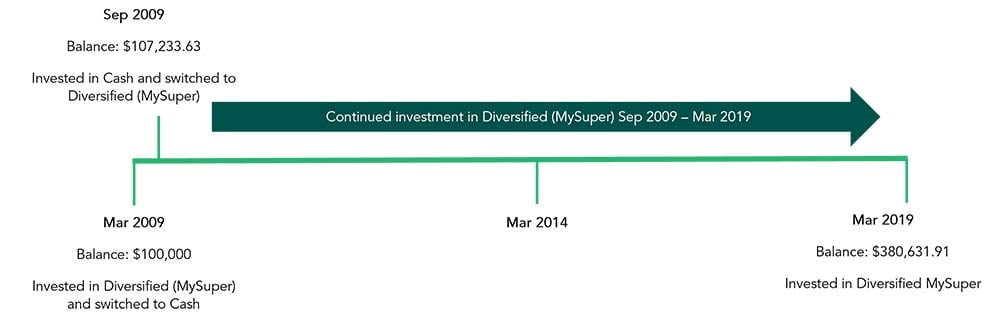

Scenario 1 — Gerald’s journey through the Global Financial Crisis

Gerald had a balance of $100,000 in his accumulation account and was 100% invested in Diversified (MySuper) in March 2009. When he saw the stock market plunge, Gerald decided to change his investment option from Diversified (MySuper) to the Cash investment option in the hope of limiting his losses. He received his usual monthly superannuation guarantee (SG) contributions of $1,000 per month (net after tax, insurance premiums and admin fees) from March 2009. After 6 months in the Cash investment option, in September 2009 Gerald felt the volatility had subsided and switched back to Diversified (MySuper) with a balance of approximately $107,233.63. Gerald remained invested in the Diversified (MySuper) investment option for the next 10 years. As of March 2019, Gerald’s account balance was approximately $380,631.91.

Scenario 1 Timeline — Switching

This scenario assumes monthly SG contributions of $100 (0 from Mar 2009 – Mar 2019)

But what if Gerald hadn’t switched his investment option in March 2009?

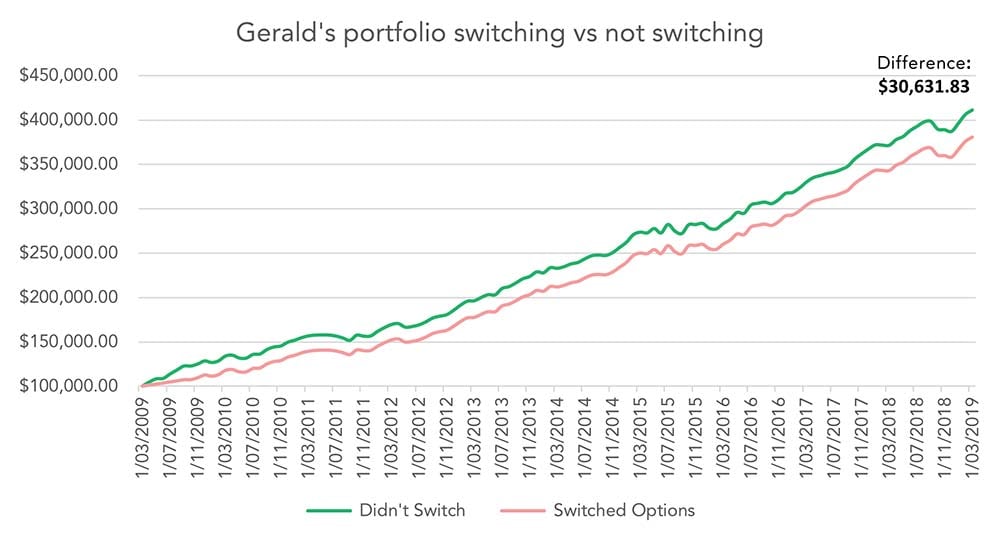

The market gradually climbed back in the second half of 2009, which would have seen Gerald’s account balance reach $122,690.12 in September 2009 (compared to $107,233.63). After 10 years, the value of his portfolio would have been $411,263.73, significantly higher than the $380,631.93 that resulted from his switching strategy.

Graph A below illustrates Gerald’s superannuation portfolio when he switched in March 2009 (pink line) and the hypothetical account balance if he hadn't switched and stayed the course (green line). Over the 10-year period, staying the course would have resulted in an additional $30,631.83 in Gerald’s portfolio (approximately).

Graph A – Portfolio value switching vs not switching (Global Financial Crisis)

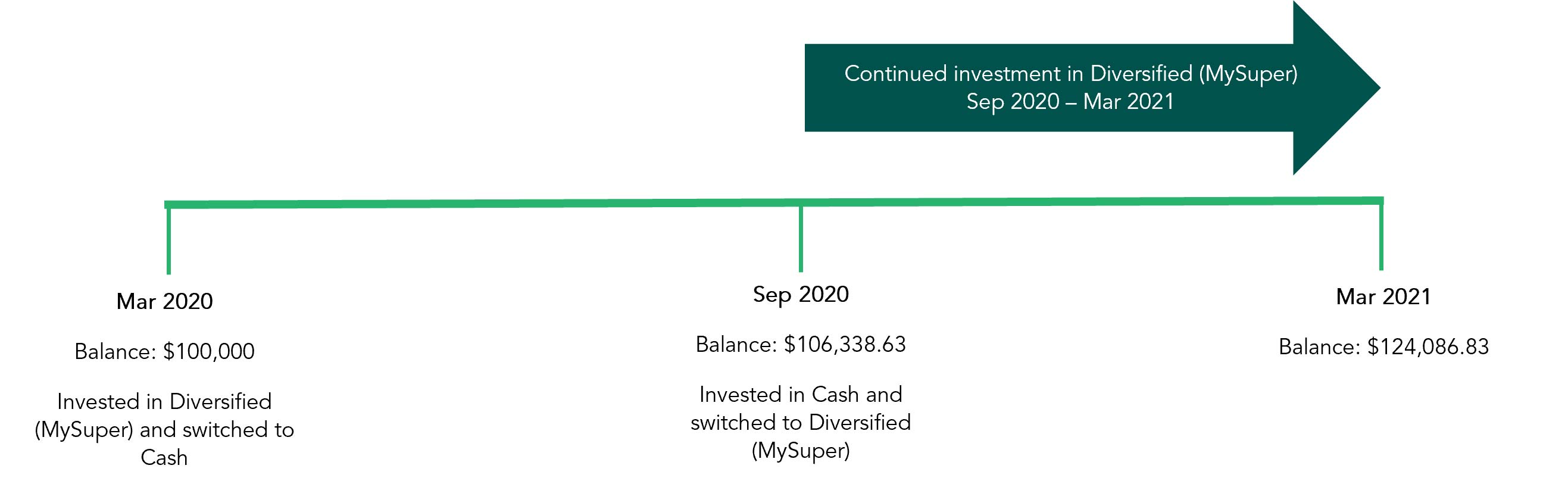

Scenario 2 — Carol’s journey and the onset of the COVID-19 pandemic

A similar situation occurred in March 2020 when the coronavirus pandemic hit us. Let’s take a look at Carol’s journey. Carol had $100,000 invested in the Diversified (MySuper) investment option in March 2020. The ASX200 took a dive, wiping off over 32% in just one month. Carol followed a similar strategy to Gerald and switched from the Diversified (MySuper) investment option to Cash in March 2020. Carol received her usual monthly superannuation guarantee (SG) contributions of $1,000 per month (net after tax, insurance premiums and admin fees) from March 2020. She stayed in the Cash investment option for 6 months. By September 2020, Carol’s balance had grown to $106,338.63. At this time Carol thought the volatility had subsided and decided to switch back to the Diversified (MySuper) investment option. As of March 2021, exactly 12 months later, Carol had $124,086.83 in her account.

Scenario 2 Timeline — Switching

This scenario assumes monthly SG contributions of $1000 from Mar 2020 – Mar 2021

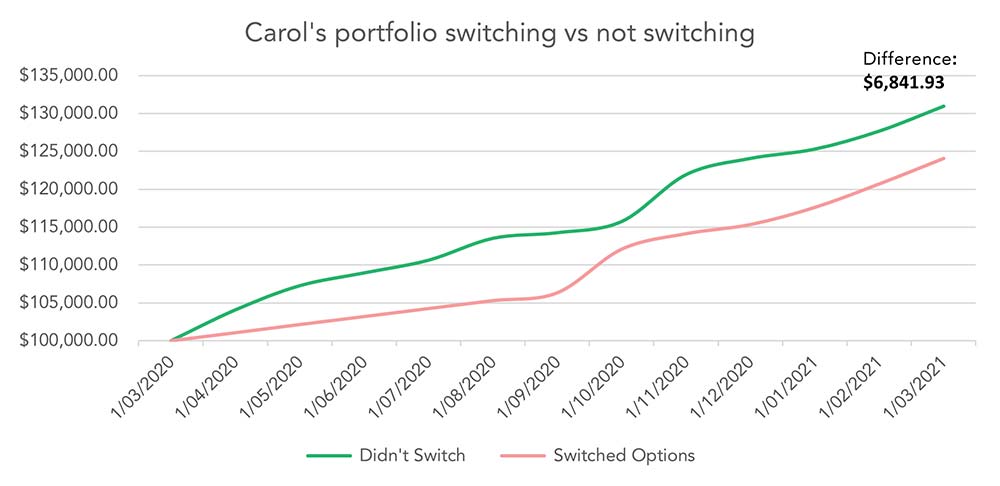

But what if Carol hadn't switched her investment option in March 2020?

Graph B below illustrates Carol’s superannuation portfolio value when she switched in March 2020 (pink line) and the hypothetical account balance if she hadn't switched and stayed the course (green line). Over only a 12-month period, staying the course would have resulted in an additional $6,841.93 in Carol’s portfolio (approximately).

Graph B — Portfolio value switching vs not switching (COVID-19 pandemic)

Active risk mitigation

NGS Super adopts an active approach to mitigating short-term market risks through various levers of protection, including diversification, dynamic asset allocation and tactical hedging. As at 10 June 2022, the global equity market (MSCI ACWI Index2) had fallen by 13.84% (since 1 July 2021), while our Diversified option had fallen by 2.37%. Negative returns are never desirable, but as you can see from these figures, the fall in the markets is substantially softened in our portfolio by the defensive levers we have in place. In February, we tactically increased gold allocation to hedge geopolitical risk, helping to stabilise the portfolio, and in May we adjusted duration hedging to protect against possible recessionary outcomes. As long-term investors, we are positioned to benefit from long-term risk premia as market timing is not only difficult but also dangerous. Switching out during every market sell-off could lead to lower investment returns in the long term.

Additional consideration

As much as we try to generalise the research to fit all our members, we acknowledge that there are nuanced cases where additional considerations might apply. For members with a very short investment horizon, a very low risk tolerance, or upcoming lump sum expenditures, the decision around switching becomes a trade-off between opportunity costs and capital preservation. Some members may decide to forgo the opportunity cost for capital preservation to best satisfy their personal needs. In this case, consider talking to our financial planners to receive more personalised advice.3 But, in general, for most of our members with an investment horizon of over 10 years, switching during short-term market selloffs erodes long-term returns.

Conclusion

As we show in the 2 simple case studies, we find that switching out investment options for cash during high uncertainty is not necessarily a good strategy for long-term investors. You may also miss the best opportunities during market rebounds after sell-offs. In addition, we actively mitigate short-term market risk through different layers of protection to ensure a better financial outcome for our members in the long term.

1 Global Financial Crisis and COVID-19 Pandemic.

2 https://www.msci.com/our-solutions/indexes/acwi.

3 NGS Financial Planning Pty Ltd, ABN 89 134 620 518, is a corporate authorised representative #394909 of Guideway Financial Services Pty Ltd, ABN 46 156 498 538, AFSL #420367 and offers financial planning services on behalf of NGS Super ABN 73 549 180 515.